Altcoin XRP Reclaims $2 Price Igniting Bullish Expectations for ATH in 2026, Next Target $2.30 Resistance

Altcoin XRP reclaims $2 price igniting bullish expectations for ATH in 2026.

The popular altcoin asset is now moving to its next resistance target at $2.30.

XRP remains to be one of the most bullish assets in the market.

The popular altcoin XRP continues to draw massive interest as the

CryptoNewsLand·3m ago

Tesla Q4 vehicle deliveries drop 16%, replaced by BYD as the leading brand. Michael Burry explains why he is not shorting.

Investor Michael Burry, famous for betting against the 2008 financial crisis, has recently issued multiple warnings that signs of a bubble are emerging in AI-related topics. He has also long maintained a highly cautious stance on Tesla's valuation. However, Burry recently explained that although he still believes Tesla is severely overvalued, he has not chosen to short the stock. The main reason is that the risks and costs associated with shorting have become too high to be attractive.

Tesla Q4 Deliveries Fall Short of Expectations, BYD Becomes the World's Largest Electric Vehicle Manufacturer

Burry pointed out that from a fundamental perspective, Tesla is facing multiple pressures. Its global electric vehicle sales are showing a downward trend, market competition is intensifying, price wars are eroding margins, and growth is slowing, leading to a significant gap between the current stock price and the company's actual operational status. In his view, Tesla's overall

ChainNewsAbmedia·5m ago

Tom Lee Signals Strong Bitcoin Upside With $180,000 Price Outlook

Bitcoin has returned to the center of global market discussions after a striking forecast from Wall Street strategist Tom Lee. He believes Bitcoin could surge toward $180,000 within the next 28 days, a move that would redefine expectations across financial markets. This projection arrives as Bitcoin

BTC0,36%

Coinfomania·6m ago

Chainlink Reserve Accumulates 94,000 LINK, Expanding Treasury to 1.4 Million

Growing adoption by businesses is supporting the LINK reserve, as Chainlink converts off-chain and on-chain payments into LINK via its Payment Abstraction system.

LINK price gained 6.6% with improving market sentiment, and has moved above a key descending trendline on the 8-hour

LINK0,75%

CryptoNewsFlash·13m ago

Zcash (ZEC) To Rise Higher? Key Breakout Hints at Potential Upside Move

Date: Sat, Dec 27, 2025 | 11:04 AM GMT

Zcash (ZEC), the privacy-focused cryptocurrency, has continued to outperform much of the broader altcoin

ZEC-0,08%

CoinsProbe·13m ago

U.S. military launches large-scale attack on Venezuela: Trump confirms Maduro couple's arrest, Delta Force involved in the mission

CBS reports that the U.S. military launched a large-scale military strike against Venezuela on the morning of Saturday, January 3rd. President Trump immediately announced on Truth Social that he had captured Venezuelan President Nicolás Maduro and his wife. He stated: "The United States has carried out a large-scale operation against Venezuela and its leader Nicolás Maduro (President). Maduro and his wife have been arrested and taken out of the country." This operation was conducted in cooperation with U.S. law enforcement agencies. Further details will be announced later.

Trump is expected to hold a press conference at 11 a.m. Eastern Time at Mar-a-Lago in Florida to provide more details.

Foreign media: U.S. special forces Delta team abducts Maduro

CBS reports that U.S. elite special forces Delta team

ChainNewsAbmedia·16m ago

Ethereum Staking Demand Outpaces Withdrawals for First Time

Ethereum's staking ecosystem shows renewed strength, with more ETH being staked than withdrawn for the first time in months. This shift indicates a growing investor confidence in Ethereum's long-term prospects, despite market uncertainties and factors external to the crypto world.

ETH1,52%

Coinfomania·23m ago

Venezuela Reacts to Bitcoin Surging to $90,000: A New Benchmark

Bitcoin Dips Below $90,000 Amid Geopolitical Tensions

Bitcoin experienced a sharp decline below the $90,000 level as geopolitical tensions escalated following US military actions in Venezuela. The cryptocurrency’s price action reflected heightened volatility amid fears of broader conflict and

BTC0,36%

CryptoBreaking·24m ago

Cardano (ADA) Was Once Overlooked DOGEBALL Is Now the Best Crypto to Watch While Entry Is Cheap

In 2017, Cardano launched quietly. No viral hype. No loud influencers. Just a $0.002–$0.03 entry range, a slow build, and a lot of doubt. Critics questioned its pace, its research-heavy approach, and whether it could ever compete with Ethereum.

Fast forward to today: Cardano trades around $0.35,

BlockChainReporter·26m ago

XRP Could Rally 71% After Breakout, Weekly Chart Signals - U.Today

Crypto analyst Steph is Crypto identifies a potential 71% gain for XRP, highlighting a triangle setup on its weekly chart. Following recent price increases, XRP has shown signs of recovery after 393 days of sideways trading and regained over $2.

XRP5,81%

UToday·26m ago

Is Aster (ASTER) Poised for a Breakout? This Key Pattern Formation Suggests So!

Date: Fri, Jan 02, 2026 | 10:54 AM GMT

The broader cryptocurrency market has started the new year with modest strength, as both Bitcoin (BTC)

CoinsProbe·28m ago

Avalanche Marks 2025 As Breakout Year for Onchain Growth

Avalanche achieved record growth in 2025, with over 400 million transactions and 32 million smart contracts on its C-Chain. The ecosystem attracted 810,000 daily users and saw nearly $1 trillion in trading volume. RWA value peaked at $2.9 billion, emphasizing its strong economic model.

AVAX3,71%

BlockChainReporter·33m ago

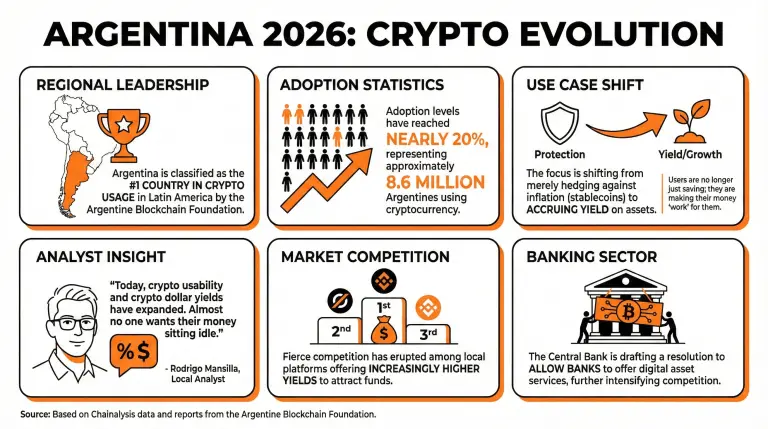

Argentina Enters 2026 With Cryptocurrency Adoption Levels Reaching 20%

The number is taken from a mid-2025 report by Chainalysis, remarking on the reach and potential of cryptocurrencies in Argentina. While the initial use case of crypto was related to stablecoins and preserving purchasing value, analysts claim this is also evolving.

Argentina Enters 2026 With High C

Coinpedia·34m ago

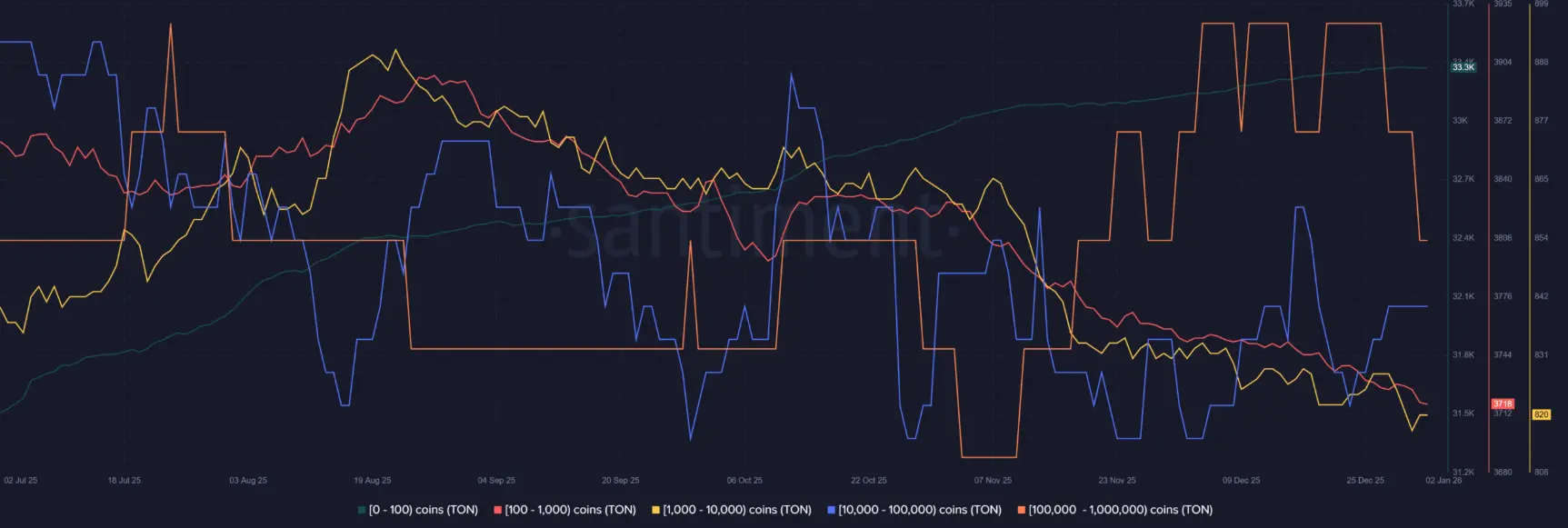

Toncoin breaks through the key resistance level, what are the next prospects?

Toncoin (TON) has gained 2% in the past 24 hours, bringing the total weekly increase to 12.5%. This bullish momentum is believed to be driven by Telegram's decision to officially launch the (self-custodial wallet) in the US market – a significant step towards opening

TapChiBitcoin·34m ago

Pump.fun's cash withdrawals in Q4 spark controversy over Web3 profits

Large cash transfer transactions from the meme coin platform Pump.fun on Solana are sparking heated debates in the crypto community. While it reported significant profits and high revenues, critics argue these withdrawals reveal a gap between operators and small investors, raising sustainability concerns.

TapChiBitcoin·34m ago

DOGEBALL’s Crypto Presale Begins: Can a $100 Investment Turn Into $100,000? | Hyperliquid & Solan...

Speculation is heating up as DOGEBALL, Hyperliquid, and Solana dominate early-2026 crypto presale conversations, with BONK and PEPE comparisons resurfacing across social channels and every price prediction thread. As traders hunt the next asymmetric opportunity, attention is shifting toward

BlockChainReporter·35m ago

Load More

Hot Topics

MoreCrypto Calendar

MoreOM Token Göçü Sona Erdi

MANTRA Chain, kullanıcıları OM token'larını 15 Ocak'tan önce MANTRA Chain ana ağına taşımaları için bir hatırlatma yayınladı. Taşıma işlemi, $OM'nin yerel zincirine geçişi sırasında ekosistemdeki katılıma devam edilmesini sağlar.

2026-01-14

CSM Fiyat Değişikliği

Hedera, Ocak 2026'dan itibaren KonsensüsSubmitMessage hizmeti için sabit USD ücretinin $0.0001'den $0.0008'e yükseleceğini duyurdu.

2026-01-27

Vesting Kilidi Gecikti

Router Protocol, ROUTE tokeninin Hakediş kilidinin 6 aylık bir gecikme ile açılacağını duyurdu. Ekip, projenin Open Graph Architecture (OGA) ile stratejik uyum sağlamak ve uzun vadeli ivmeyi koruma hedefini gecikmenin başlıca nedenleri olarak belirtiyor. Bu süre zarfında yeni kilit açılımları gerçekleşmeyecek.

2026-01-28

Tokenların Kilidini Aç

Berachain BERA, 6 Şubat'ta yaklaşık 63,750,000 BERA tokenini serbest bırakacak ve bu, mevcut dolaşımdaki arzın yaklaşık %59.03'ünü oluşturacaktır.

2026-02-05

Tokenların Kilidini Aç

Wormhole, 3 Nisan'da 1.280.000.000 W token açacak ve bu, mevcut dolaşımdaki arzın yaklaşık %28,39'unu oluşturacak.

2026-04-02