# macro

861.34K

Ajauujs562

Bitcoin as a Check on Fiat Power!

Coinbase CEO Brian Armstrong makes a sharp point: Bitcoin is good for the U.S. dollar.

Why? Because $BTC introduces discipline. In a world of rising inflation and expanding deficit spending, a fixed-supply asset acts as a check and balance on monetary excess. It forces policymakers, markets, and institutions to operate with more transparency and restraint.

Rather than weakening USD, Bitcoin highlights its vulnerabilities and that pressure can drive better fiscal behavior over the long term.

Strong money doesn't fear competition. It improves because of it!

#Bit

Coinbase CEO Brian Armstrong makes a sharp point: Bitcoin is good for the U.S. dollar.

Why? Because $BTC introduces discipline. In a world of rising inflation and expanding deficit spending, a fixed-supply asset acts as a check and balance on monetary excess. It forces policymakers, markets, and institutions to operate with more transparency and restraint.

Rather than weakening USD, Bitcoin highlights its vulnerabilities and that pressure can drive better fiscal behavior over the long term.

Strong money doesn't fear competition. It improves because of it!

#Bit

BTC2,03%

- Reward

- like

- Comment

- Repost

- Share

THE DOLLAR FEELS DIFFERENT THIS YEAR 🇺🇸

The steady decline of the US Dollar in 2025 feels more structural than emotional. No panic — just persistent weakness.

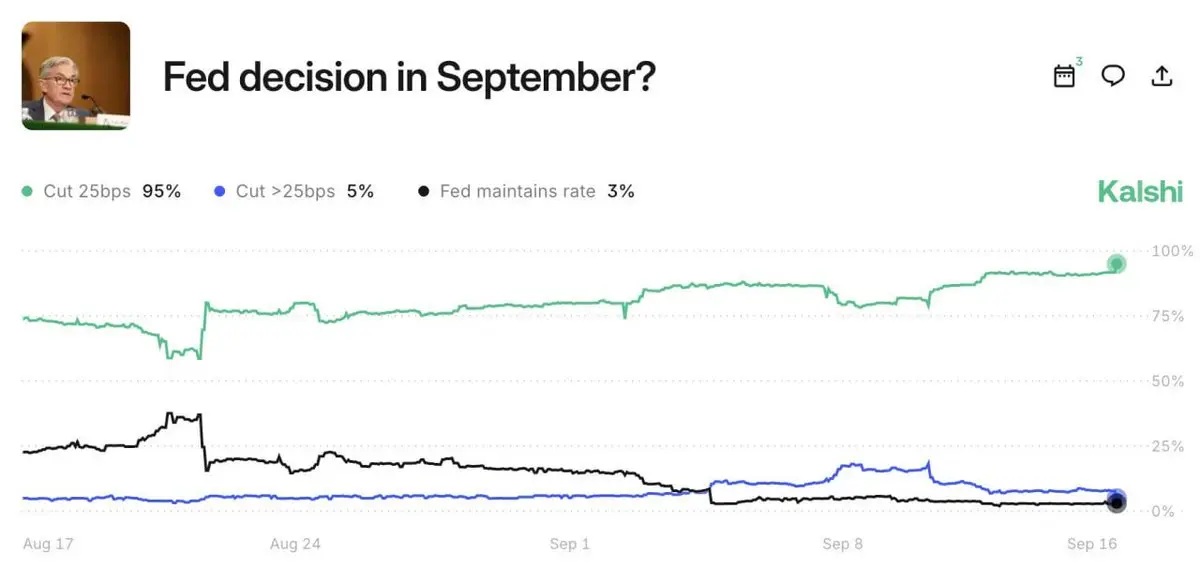

🔻 With the *Federal Reserve easing rates* multiple times this year, and *softer economic data* (cooling jobs, lower inflation), global sentiment is shifting.

🌍 Capital is quietly flowing elsewhere — in search of stability and growth.

💹 Crypto is no longer just a trade — it’s becoming a serious alternative narrative.

🧠 Smart investors stay flexible.

📉 Don’t chase noise. Watch macro moves.

📈 Prepare for long-term trends.

The steady decline of the US Dollar in 2025 feels more structural than emotional. No panic — just persistent weakness.

🔻 With the *Federal Reserve easing rates* multiple times this year, and *softer economic data* (cooling jobs, lower inflation), global sentiment is shifting.

🌍 Capital is quietly flowing elsewhere — in search of stability and growth.

💹 Crypto is no longer just a trade — it’s becoming a serious alternative narrative.

🧠 Smart investors stay flexible.

📉 Don’t chase noise. Watch macro moves.

📈 Prepare for long-term trends.

- Reward

- like

- Comment

- Repost

- Share

IREN Is Quietly Leading the Bitcoin Mining Pack

IREN has emerged as the standout Bitcoin mining company this year, delivering nearly 300% YTD gains and it's not just because of Bitcoin. What sets IREN apart is strategy. While others rely purely on mining cycles, IREN has diversified into Al and high-performance computing, creating multiple revenue engines beyond $BTC alone.

In a market that rewards adaptability, IREN is proving that the future of mining isn't just hash rate, it's infrastructure, scalability, and optionality.

#Bitcoin #Macro #Insights

IREN has emerged as the standout Bitcoin mining company this year, delivering nearly 300% YTD gains and it's not just because of Bitcoin. What sets IREN apart is strategy. While others rely purely on mining cycles, IREN has diversified into Al and high-performance computing, creating multiple revenue engines beyond $BTC alone.

In a market that rewards adaptability, IREN is proving that the future of mining isn't just hash rate, it's infrastructure, scalability, and optionality.

#Bitcoin #Macro #Insights

BTC2,03%

- Reward

- like

- Comment

- Repost

- Share

Japan Jolt Hits Global Markets!

The Bank of Japan just hiked 75bps in 72 hours — a shockwave through global liquidity. Easy money is off, and the carry trade is unraveling. Stocks and crypto are flashing red.

What to watch:

Trump warns: global rate hikes threaten growth

Fed in the hot seat — pivot or hold?

Volatility spikes: chaos = opportunity

Crypto frontlines:

$FORM +10.13% | $OM +18.62% | $EPIC +18.62% 🚀

Cheap money just hit a brick wall in Tokyo. Stay alert — the markets are shaking!

#Macro #JapanShock #Crypto #Volatility

The Bank of Japan just hiked 75bps in 72 hours — a shockwave through global liquidity. Easy money is off, and the carry trade is unraveling. Stocks and crypto are flashing red.

What to watch:

Trump warns: global rate hikes threaten growth

Fed in the hot seat — pivot or hold?

Volatility spikes: chaos = opportunity

Crypto frontlines:

$FORM +10.13% | $OM +18.62% | $EPIC +18.62% 🚀

Cheap money just hit a brick wall in Tokyo. Stay alert — the markets are shaking!

#Macro #JapanShock #Crypto #Volatility

- Reward

- like

- 10

- Repost

- Share

Khan_111 :

:

Ape In 🚀View More

🚨 CPI DAY – Market on Edge

US CPI release: 8:30AM ET

Expectation: 2.9%

Impact:

👉 Lower than 2.9% = Bullish breakout

👉 At 2.9% = Correction risk

👉 Above 2.9% = Bearish shock

Reminder: Yesterday’s soft PPI strengthens the case for 50bps cut.

#Bitcoin #CryptoMarket #macro

US CPI release: 8:30AM ET

Expectation: 2.9%

Impact:

👉 Lower than 2.9% = Bullish breakout

👉 At 2.9% = Correction risk

👉 Above 2.9% = Bearish shock

Reminder: Yesterday’s soft PPI strengthens the case for 50bps cut.

#Bitcoin #CryptoMarket #macro

BTC2,03%

- Reward

- like

- Comment

- Repost

- Share

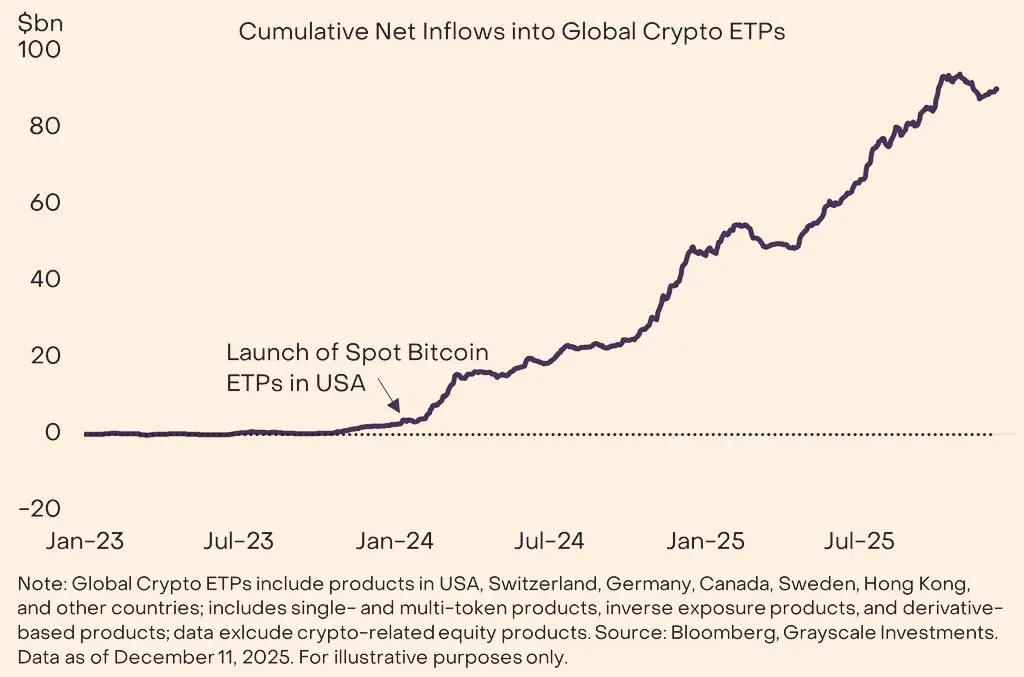

Bitcoin ETPs Changed the Game!

Since the launch of U.S. $BTC ETPs in January 2024, global crypto ETPs have recorded $87 billion in net inflows. This reflects a structural shift, with institutions increasingly accessing crypto through regulated products rather than direct spot exposure.

The quiet flow of capital often matters more than the loud price moves!

#Bitcoin #Macro #Insights

Since the launch of U.S. $BTC ETPs in January 2024, global crypto ETPs have recorded $87 billion in net inflows. This reflects a structural shift, with institutions increasingly accessing crypto through regulated products rather than direct spot exposure.

The quiet flow of capital often matters more than the loud price moves!

#Bitcoin #Macro #Insights

BTC2,03%

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

135.1K Popularity

3.29K Popularity

48.4K Popularity

1.37K Popularity

700 Popularity

390 Popularity

394 Popularity

18.16K Popularity

85.98K Popularity

18.9K Popularity

208.71K Popularity

8.68K Popularity

9.36K Popularity

1.56K Popularity

219.52K Popularity

News

View MoreInstitution: Gold prices retreat as investors lock in profits

1 m

ADA price rebounds 10%, Can Cardano break out of a true recovery trend before 2026?

2 m

SQD (Subsquid) up 20.45% in the past 24 hours

2 m

NFT popularity wanes, why are traders turning to high-volume Meme coins?

6 m

Gold stablecoins are entering a period of explosive growth, with the market capitalization potentially approaching $4 billion by 2025.

10 m

Pin