# MiddleEastTensionsEscalate

37.17K

Rising U.S.–Iran tensions have driven gold above the $5,000 milestone, while Bitcoin has pulled back and market sentiment turns cautious. Would you allocate to gold now, or look for a BTC dip?

MrFlower_XingChen

#MiddleEastTensionsEscalate | Geopolitical Pressure Reshaping Global and Crypto Markets

The escalating tensions in the Middle East are increasingly influencing global financial behavior, pushing markets into a heightened state of caution. Cryptocurrency is no longer reacting in isolation but moving as part of the broader macro environment, where geopolitical developments, energy dynamics, and global risk perception now play a decisive role in price direction and investor behavior.

As uncertainty intensifies, capital across both traditional and digital markets is shifting into protection mode.

The escalating tensions in the Middle East are increasingly influencing global financial behavior, pushing markets into a heightened state of caution. Cryptocurrency is no longer reacting in isolation but moving as part of the broader macro environment, where geopolitical developments, energy dynamics, and global risk perception now play a decisive role in price direction and investor behavior.

As uncertainty intensifies, capital across both traditional and digital markets is shifting into protection mode.

BTC-1,52%

- Reward

- 10

- 20

- Repost

- Share

Peacefulheart :

:

1000x VIbes 🤑View More

#MiddleEastTensionsEscalate The escalating situation in the Middle East is increasingly shaping global financial behavior, and cryptocurrencies are now responding as part of the broader macro system rather than in isolation. What was once largely driven by technical patterns and on-chain cycles has shifted into a news-sensitive, geopolitically reactive environment, where every headline can trigger immediate market responses.

As regional tensions rise, global capital flows are becoming defensive. Investors across traditional and digital markets prioritize liquidity, capital preservation, and do

As regional tensions rise, global capital flows are becoming defensive. Investors across traditional and digital markets prioritize liquidity, capital preservation, and do

- Reward

- 3

- 3

- Repost

- Share

Peacefulheart :

:

2026 GOGOGO 👊View More

#MiddleEastTensionsEscalate | A Structural Revival, Not a Speculative Return

GameFi has re-entered the broader market narrative with renewed strength, signaling that its earlier decline was not a failure, but a necessary phase of transformation. Early 2026 marks the emergence of a redesigned digital gaming economy built around sustainability, scalability, and authentic user engagement rather than short-term token incentives.

This rebound is driven by structural recovery rather than speculative enthusiasm. Capital is no longer rotating blindly into experimental concepts. Attention now shifts to

GameFi has re-entered the broader market narrative with renewed strength, signaling that its earlier decline was not a failure, but a necessary phase of transformation. Early 2026 marks the emergence of a redesigned digital gaming economy built around sustainability, scalability, and authentic user engagement rather than short-term token incentives.

This rebound is driven by structural recovery rather than speculative enthusiasm. Capital is no longer rotating blindly into experimental concepts. Attention now shifts to

ETHS16,44%

- Reward

- 2

- 1

- Repost

- Share

Peacefulheart :

:

1000x VIbes 🤑#MiddleEastTensionsEscalate #🌍 #MiddleEastTensionsEscalate Future Market Outlook

Crypto Enters a High-Volatility Macro Era (Forward View 2026)

As geopolitical pressure across the Middle East continues to reshape global risk sentiment, the crypto market is transitioning into a macro-dominated phasewhere headlines move price faster than charts.

This is no longer just a technical market.

It’s a news-reactive, liquidity-sensitive, institution-driven battlefield.

Let’s break down what comes next.

📊 Forward Crypto Market Projection (Next Phase)

Bitcoin (BTC)

Expected Range: $88K – $102K

Projecte

Crypto Enters a High-Volatility Macro Era (Forward View 2026)

As geopolitical pressure across the Middle East continues to reshape global risk sentiment, the crypto market is transitioning into a macro-dominated phasewhere headlines move price faster than charts.

This is no longer just a technical market.

It’s a news-reactive, liquidity-sensitive, institution-driven battlefield.

Let’s break down what comes next.

📊 Forward Crypto Market Projection (Next Phase)

Bitcoin (BTC)

Expected Range: $88K – $102K

Projecte

- Reward

- 12

- 11

- Repost

- Share

Peacefulheart :

:

2026 GOGOGO 👊View More

#GameFiSeesaStrongRebound

GameFi’s Second Act: Why Seesa’s Comeback Signals a Broader Sector Shift

After a long period of stagnation, the GameFi sector is showing signs of renewed vitality and this time, the momentum seems fundamentally different. The recent uptick in prices only tells part of the story. The rebound, led by projects like Seesa, reflects a deeper transformation in how GameFi is built, funded, and experienced.

Unlike previous spikes, this recovery appears to be grounded in structural change rather than fleeting speculation.

From Hype to Sustainable Ecosystems

Early GameFi was d

GameFi’s Second Act: Why Seesa’s Comeback Signals a Broader Sector Shift

After a long period of stagnation, the GameFi sector is showing signs of renewed vitality and this time, the momentum seems fundamentally different. The recent uptick in prices only tells part of the story. The rebound, led by projects like Seesa, reflects a deeper transformation in how GameFi is built, funded, and experienced.

Unlike previous spikes, this recovery appears to be grounded in structural change rather than fleeting speculation.

From Hype to Sustainable Ecosystems

Early GameFi was d

- Reward

- 1

- Comment

- Repost

- Share

📈 Geopolitical Risk Pushes Gold Up — BTC Pulls Back: What’s Your Allocation Call?

Recent market moves show gold surging past major milestones as geopolitical tensions, especially around the Middle East, are driving investor caution and risk-off flows. Spot gold recently hit record territory above $5,000/oz, buoyed by safe-haven demand amid U.S.–Iran conflict fears and broader macro uncertainty.

Meanwhile, Bitcoin has retreated from recent highs, slipping below key psychological levels as risk sentiment cools and traders rotate into perceived safe assets.

🔎 Market Drivers Right Now

1) Safe-

Recent market moves show gold surging past major milestones as geopolitical tensions, especially around the Middle East, are driving investor caution and risk-off flows. Spot gold recently hit record territory above $5,000/oz, buoyed by safe-haven demand amid U.S.–Iran conflict fears and broader macro uncertainty.

Meanwhile, Bitcoin has retreated from recent highs, slipping below key psychological levels as risk sentiment cools and traders rotate into perceived safe assets.

🔎 Market Drivers Right Now

1) Safe-

BTC-1,52%

- Reward

- 3

- 2

- Repost

- Share

QueenOfTheDay :

:

2026 GOGOGO 👊View More

#MiddleEastTensionsEscalate

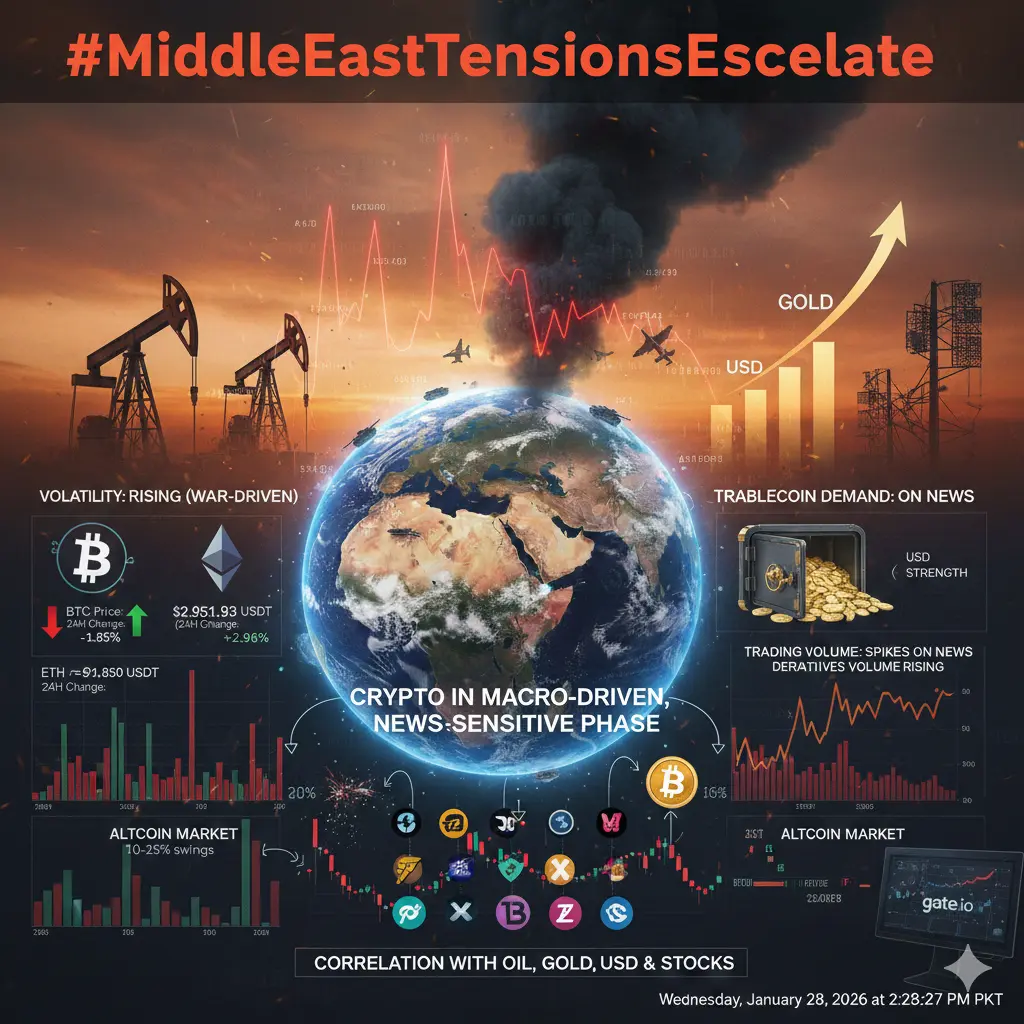

The escalating conflict in the Middle East is increasingly influencing global financial markets, and the cryptocurrency market is now directly feeling the impact across liquidity flows, trading volumes, volatility levels, price movements, derivatives positioning, and investor sentiment.

This geopolitical escalation is pushing crypto into a macro-driven, news-sensitive phase, where war risk, oil price shocks, and global risk appetite are shaping price direction more than pure technical trends.

📊 Live Crypto Market Snapshot (Gate.io Reference)

🔹 Bitcoin (BTC)

Price

The escalating conflict in the Middle East is increasingly influencing global financial markets, and the cryptocurrency market is now directly feeling the impact across liquidity flows, trading volumes, volatility levels, price movements, derivatives positioning, and investor sentiment.

This geopolitical escalation is pushing crypto into a macro-driven, news-sensitive phase, where war risk, oil price shocks, and global risk appetite are shaping price direction more than pure technical trends.

📊 Live Crypto Market Snapshot (Gate.io Reference)

🔹 Bitcoin (BTC)

Price

- Reward

- 28

- 57

- Repost

- Share

repanzal :

:

Happy New Year! 🤑View More

#MiddleEastTensionsEscalate 🌍⚠️

Global markets once again move into risk-sensitive mode as Middle East tensions intensify.

Geopolitical uncertainty is rising — and history shows markets never ignore this for long.

Why this matters for financial markets & crypto:

🔺 Oil prices react first

Supply risk fears push energy markets higher, adding inflation pressure globally.

💰 Safe-haven assets gain attention

Gold strengthens, while capital becomes more selective across risk assets.

📉 Risk assets turn cautious

Equities and high-beta crypto assets face volatility as investors reduce exposure.

🪙 Cr

Global markets once again move into risk-sensitive mode as Middle East tensions intensify.

Geopolitical uncertainty is rising — and history shows markets never ignore this for long.

Why this matters for financial markets & crypto:

🔺 Oil prices react first

Supply risk fears push energy markets higher, adding inflation pressure globally.

💰 Safe-haven assets gain attention

Gold strengthens, while capital becomes more selective across risk assets.

📉 Risk assets turn cautious

Equities and high-beta crypto assets face volatility as investors reduce exposure.

🪙 Cr

BTC-1,52%

- Reward

- 8

- 9

- Repost

- Share

MrThanks77 :

:

Happy New Year! 🤑View More

WHAT'S THE WAY FORWARD FOR BITCOIN?

PUMPING OR DUMPING SOON ? FIND OUT HERE:

As of January 27, 2026, Bitcoin ($BTC ) is trading around $87,700 - $88,600 (With a live price of $88,300 at the time of writing) showing signs of consolidation after recent volatility. The cryptocurrency has been under pressure from macroeconomic factors, geopolitical tensions (such as U.S.-Iran issues), and market rotations away from risk assets. This has led to a choppy trading environment, with BTC struggling to reclaim higher levels like $90,000 while defending key supports. Short-Term Price Movement (1-30 D

PUMPING OR DUMPING SOON ? FIND OUT HERE:

As of January 27, 2026, Bitcoin ($BTC ) is trading around $87,700 - $88,600 (With a live price of $88,300 at the time of writing) showing signs of consolidation after recent volatility. The cryptocurrency has been under pressure from macroeconomic factors, geopolitical tensions (such as U.S.-Iran issues), and market rotations away from risk assets. This has led to a choppy trading environment, with BTC struggling to reclaim higher levels like $90,000 while defending key supports. Short-Term Price Movement (1-30 D

BTC-1,52%

- Reward

- 5

- 3

- Repost

- Share

Bitcoinworld90 :

:

$AXS This isn’t a pump. This is acceptance after expansion. Smart money already positioned. $AXS

View More

WHAT'S THE WAY FORWARD FOR BITCOIN?

PUMPING OR DUMPING SOON ? FIND OUT HERE:

As of January 27, 2026, Bitcoin ($BTC ) is trading around $87,700 - $88,600 (With a live price of $88,300 at the time of writing) showing signs of consolidation after recent volatility. The cryptocurrency has been under pressure from macroeconomic factors, geopolitical tensions (such as U.S.-Iran issues), and market rotations away from risk assets. This has led to a choppy trading environment, with BTC struggling to reclaim higher levels like $90,000 while defending key supports. Short-Term Price Movement (1-30 D

PUMPING OR DUMPING SOON ? FIND OUT HERE:

As of January 27, 2026, Bitcoin ($BTC ) is trading around $87,700 - $88,600 (With a live price of $88,300 at the time of writing) showing signs of consolidation after recent volatility. The cryptocurrency has been under pressure from macroeconomic factors, geopolitical tensions (such as U.S.-Iran issues), and market rotations away from risk assets. This has led to a choppy trading environment, with BTC struggling to reclaim higher levels like $90,000 while defending key supports. Short-Term Price Movement (1-30 D

BTC-1,52%

- Reward

- 5

- 3

- Repost

- Share

Bitcoinworld90 :

:

Buy To Earn 💎View More

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

23.46K Popularity

87.46K Popularity

37.17K Popularity

13K Popularity

13.37K Popularity

12K Popularity

11.13K Popularity

11.04K Popularity

76.55K Popularity

23.71K Popularity

84.5K Popularity

22.42K Popularity

52.95K Popularity

46.18K Popularity

199.14K Popularity

News

View MoreFalcon Finance's stablecoin USDf experiences slight depegging

3 m

XRP (XRP Ledger) decreased by 1.38% in the past 24 hours, currently trading at $1.87

6 m

Since October 2025, the giant whale gradually building a position in digital gold has realized a profit of $3,865,000.

7 m

ETH (Ethereum) decreased by 1.72% in the past 24 hours, currently at $2953.36

8 m

NVIDIA, Microsoft, and Amazon are in talks to invest approximately $60 billion in OpenAI

9 m

Pin