# TariffTensionsHitCryptoMarket

76.02K

Renewed tariff threats have lifted risk-off sentiment, with BTC seeing a sharp pullback after a brief surge. Is the market pricing in escalating trade tensions, or just reacting emotionally? What’s your outlook?

MrFlower_XingChen

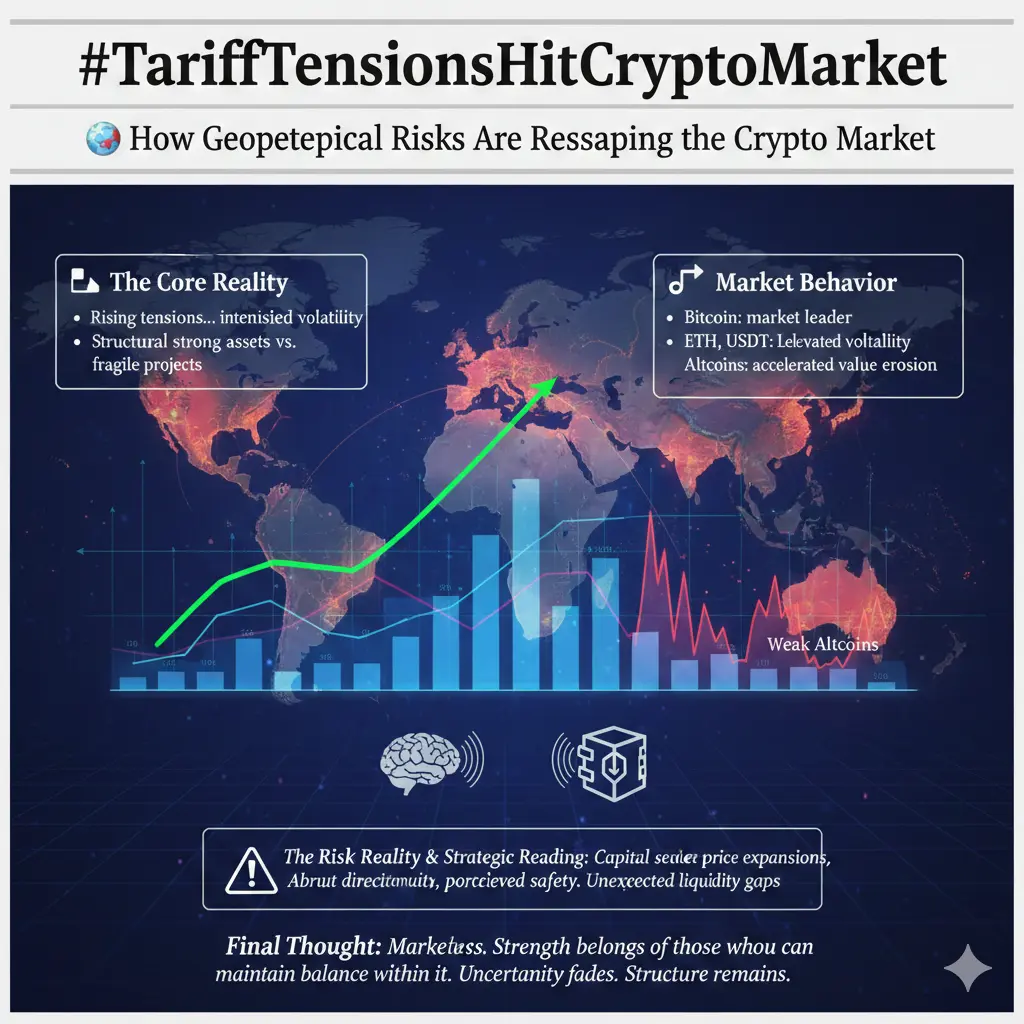

#TariffTensionsHitCryptoMarket 🌍 How Geopolitical Risks Are Reshaping the Crypto Market

Geopolitical tensions don’t just dominate global headlines — they quietly redirect capital flows, reshape market structure, and redefine investor priorities. In periods of heightened uncertainty, crypto markets reward resilience, not speed.

📊 The Core Reality

Escalating tensions in the Middle East alongside the prolonged Ukraine–Russia conflict have intensified volatility across digital assets. As risk perception rises, the gap between structurally strong assets and fragile projects is becoming increasing

Geopolitical tensions don’t just dominate global headlines — they quietly redirect capital flows, reshape market structure, and redefine investor priorities. In periods of heightened uncertainty, crypto markets reward resilience, not speed.

📊 The Core Reality

Escalating tensions in the Middle East alongside the prolonged Ukraine–Russia conflict have intensified volatility across digital assets. As risk perception rises, the gap between structurally strong assets and fragile projects is becoming increasing

- Reward

- 16

- 34

- Repost

- Share

ybaser :

:

Happy New Year! 🤑View More

Bitcoin Target of $185,000: Insightful Projections from Tiger Research

The cryptocurrency market is always an exciting and volatile environment. Recent downturns have left investors feeling uneasy, but some analysts still paint a positive picture. The latest report from Tiger Research, an Asia-based crypto and Web3 research firm, seems to offer a glimmer of hope to the market.

Tiger Research has announced a target of $185,500 for Bitcoin in the short term. This ambitious target has sparked considerable curiosity within the market. However, analysts also emphasized that the $84,000 level remai

The cryptocurrency market is always an exciting and volatile environment. Recent downturns have left investors feeling uneasy, but some analysts still paint a positive picture. The latest report from Tiger Research, an Asia-based crypto and Web3 research firm, seems to offer a glimmer of hope to the market.

Tiger Research has announced a target of $185,500 for Bitcoin in the short term. This ambitious target has sparked considerable curiosity within the market. However, analysts also emphasized that the $84,000 level remai

BTC-0,24%

- Reward

- 62

- 67

- Repost

- Share

NeonBlaze :

:

Buy To Earn 💎View More

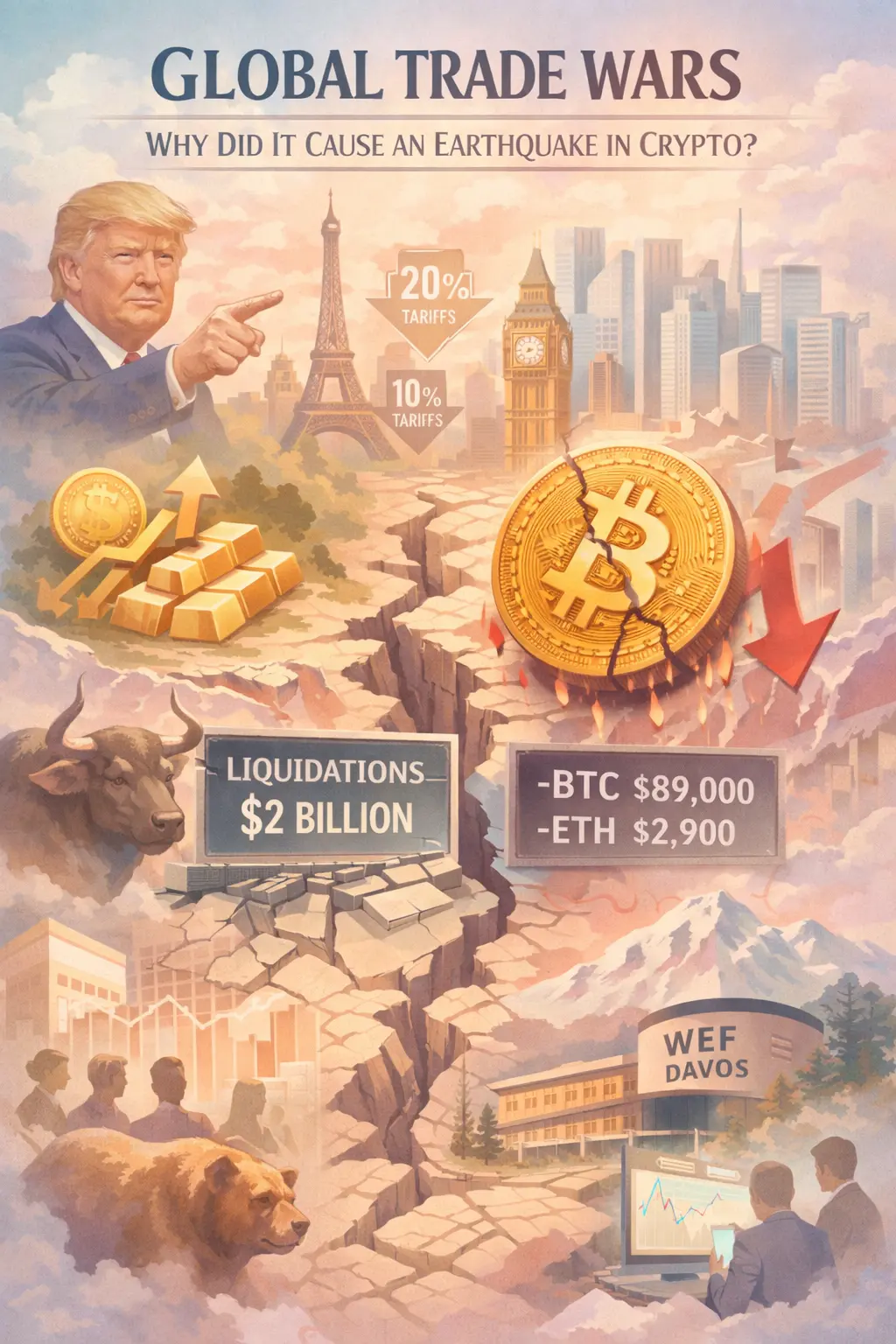

#TariffTensionsHitCryptoMarket

Since the beginning of 2026, the global economy's most discussed topic has become the primary catalyst shaking the cryptocurrency markets. U.S. President Donald Trump's tariff threats, specifically targeting the European Union (EU) and other strategic allies, have reignited the fierce debate: Are digital assets a "safe haven" or a "risk-on asset"?

Global Trade Wars: Why Did It Cause an Earthquake in Crypto?

According to traditional economic theories, customs tariffs are elements that fuel inflation and slow down economic growth. However, the events of early 2026

Since the beginning of 2026, the global economy's most discussed topic has become the primary catalyst shaking the cryptocurrency markets. U.S. President Donald Trump's tariff threats, specifically targeting the European Union (EU) and other strategic allies, have reignited the fierce debate: Are digital assets a "safe haven" or a "risk-on asset"?

Global Trade Wars: Why Did It Cause an Earthquake in Crypto?

According to traditional economic theories, customs tariffs are elements that fuel inflation and slow down economic growth. However, the events of early 2026

- Reward

- 87

- 86

- Repost

- Share

kblyfb1907 :

:

2026 GOGOGO 👊View More

#TariffTensionsHitCryptoMarket

#TariffTensionsHitCryptoMarket

January 22, 2026 highlights how deeply interconnected global politics and digital asset markets have become. Rising tariff tensions between major economies are once again sending shockwaves across financial markets, and cryptocurrencies are not immune. While crypto was once viewed as detached from traditional macro pressures, recent price action proves otherwise. As trade disputes escalate, risk sentiment weakens, liquidity tightens, and speculative assets including crypto come under renewed pressure.

Tariffs increase costs, slow

#TariffTensionsHitCryptoMarket

January 22, 2026 highlights how deeply interconnected global politics and digital asset markets have become. Rising tariff tensions between major economies are once again sending shockwaves across financial markets, and cryptocurrencies are not immune. While crypto was once viewed as detached from traditional macro pressures, recent price action proves otherwise. As trade disputes escalate, risk sentiment weakens, liquidity tightens, and speculative assets including crypto come under renewed pressure.

Tariffs increase costs, slow

- Reward

- 3

- 6

- Repost

- Share

Falcon_Official :

:

Watching Closely 🔍️View More

Title: Institutional Bitcoin Buying Remains Strong Despite Market Volatility**

The cryptocurrency market has seen its share of turbulence recently, but one key factor continues to provide a degree of stability: institutional buying. According to CryptoQuant CEO Ki Young Ju, despite significant price dips, major corporations are still accumulating Bitcoin at a robust pace.

Ju highlighted that corporate wallets have added a staggering 577,000 Bitcoin over the past year, and the inflow hasn't stopped. This trend is particularly noteworthy given the backdrop of increasing geopolitical tensions and

The cryptocurrency market has seen its share of turbulence recently, but one key factor continues to provide a degree of stability: institutional buying. According to CryptoQuant CEO Ki Young Ju, despite significant price dips, major corporations are still accumulating Bitcoin at a robust pace.

Ju highlighted that corporate wallets have added a staggering 577,000 Bitcoin over the past year, and the inflow hasn't stopped. This trend is particularly noteworthy given the backdrop of increasing geopolitical tensions and

BTC-0,24%

- Reward

- 65

- 71

- Repost

- Share

kblyfb1907 :

:

Happy New Year! 🤑View More

#TariffTensionsHitCryptoMarket 🌍 How Geopolitical Risks Are Reshaping the Crypto Market

Geopolitical tensions don’t just dominate global headlines — they quietly redirect capital flows, reshape market structure, and redefine investor priorities. In periods of heightened uncertainty, crypto markets reward resilience, not speed.

📊 The Core Reality

Escalating tensions in the Middle East alongside the prolonged Ukraine–Russia conflict have intensified volatility across digital assets. As risk perception rises, the gap between structurally strong assets and fragile projects is becoming increasing

Geopolitical tensions don’t just dominate global headlines — they quietly redirect capital flows, reshape market structure, and redefine investor priorities. In periods of heightened uncertainty, crypto markets reward resilience, not speed.

📊 The Core Reality

Escalating tensions in the Middle East alongside the prolonged Ukraine–Russia conflict have intensified volatility across digital assets. As risk perception rises, the gap between structurally strong assets and fragile projects is becoming increasing

- Reward

- 3

- 11

- Repost

- Share

ybaser :

:

Happy New Year! 🤑View More

#TariffTensionsHitCryptoMarket

Tariff Tensions Shake Crypto Markets: BTC Pulls Back Amid Rising Risk-Off Sentiment

Renewed tariff threats have rattled markets, triggering a sharp pullback in Bitcoin (BTC) and major altcoins after a brief surge. The question traders are asking: is this a rational pricing-in of escalating trade tensions, or simply an emotional knee-jerk reaction from the market? Either way, the fallout is clear risk appetite has declined, liquidity is cautious, and volatility is elevated.

BTC, as the leading bellwether, has tested key support levels following the pullback. Altc

Tariff Tensions Shake Crypto Markets: BTC Pulls Back Amid Rising Risk-Off Sentiment

Renewed tariff threats have rattled markets, triggering a sharp pullback in Bitcoin (BTC) and major altcoins after a brief surge. The question traders are asking: is this a rational pricing-in of escalating trade tensions, or simply an emotional knee-jerk reaction from the market? Either way, the fallout is clear risk appetite has declined, liquidity is cautious, and volatility is elevated.

BTC, as the leading bellwether, has tested key support levels following the pullback. Altc

- Reward

- 8

- 12

- Repost

- Share

PumpSpreeLive :

:

2026 GOGOGO 👊View More

#CryptoMarketPullback

The market started 2026 strong: BTC briefly topped ~$95K–$98K on ETF inflows, pro-crypto policy hype (CLARITY Act, Strategic Bitcoin Reserve talk), and institutional momentum.

But since mid-January, it's pulled back sharply — BTC down from highs near $98K to lows around $87K–$88K, now stabilizing ~$89K–$90K.

Broader market: 92/100 top coins red in recent 24h periods; altcoins hit harder (ETH -5%+ to ~$2,965–$3,000, SOL/XRP following suit).

Sentiment flipped: Fear & Greed Index back in "fear" zone; options pricing in ~30% chance BTC dips below $80K by late June (downside

The market started 2026 strong: BTC briefly topped ~$95K–$98K on ETF inflows, pro-crypto policy hype (CLARITY Act, Strategic Bitcoin Reserve talk), and institutional momentum.

But since mid-January, it's pulled back sharply — BTC down from highs near $98K to lows around $87K–$88K, now stabilizing ~$89K–$90K.

Broader market: 92/100 top coins red in recent 24h periods; altcoins hit harder (ETH -5%+ to ~$2,965–$3,000, SOL/XRP following suit).

Sentiment flipped: Fear & Greed Index back in "fear" zone; options pricing in ~30% chance BTC dips below $80K by late June (downside

- Reward

- 21

- 31

- Repost

- Share

Catch88 :

:

2026 GOGOGO 👊View More

#TariffTensionsHitCryptoMarket

Tariff Tensions Shake Crypto Markets: BTC Pulls Back Amid Rising Risk-Off Sentiment

Renewed tariff threats have rattled markets, triggering a sharp pullback in Bitcoin (BTC) and major altcoins after a brief surge. The question traders are asking: is this a rational pricing-in of escalating trade tensions, or simply an emotional knee-jerk reaction from the market? Either way, the fallout is clear risk appetite has declined, liquidity is cautious, and volatility is elevated.

BTC, as the leading bellwether, has tested key support levels following the pullback. Altc

Tariff Tensions Shake Crypto Markets: BTC Pulls Back Amid Rising Risk-Off Sentiment

Renewed tariff threats have rattled markets, triggering a sharp pullback in Bitcoin (BTC) and major altcoins after a brief surge. The question traders are asking: is this a rational pricing-in of escalating trade tensions, or simply an emotional knee-jerk reaction from the market? Either way, the fallout is clear risk appetite has declined, liquidity is cautious, and volatility is elevated.

BTC, as the leading bellwether, has tested key support levels following the pullback. Altc

- Reward

- 6

- 9

- Repost

- Share

HighAmbition :

:

2026 GOGOGO 👊View More

Tariff Tensions Hit Crypto Market: Short-Term Pullback and Risk-Off Sentiment

The crypto market is reacting sharply to renewed tariff threats, which have heightened global risk-off sentiment and prompted a pullback in Bitcoin (BTC) and major altcoins after a brief surge earlier this week. Investors appear to be pricing in the possibility of escalating trade conflicts, with risk assets facing immediate pressure as uncertainty rises. While some of the market’s reaction may be rooted in fundamentals, a portion of the decline also reflects emotional responses and short-term positioning, as traders

The crypto market is reacting sharply to renewed tariff threats, which have heightened global risk-off sentiment and prompted a pullback in Bitcoin (BTC) and major altcoins after a brief surge earlier this week. Investors appear to be pricing in the possibility of escalating trade conflicts, with risk assets facing immediate pressure as uncertainty rises. While some of the market’s reaction may be rooted in fundamentals, a portion of the decline also reflects emotional responses and short-term positioning, as traders

- Reward

- 9

- 16

- Repost

- Share

DragonFlyOfficial :

:

2026 GOGOGO 👊View More

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

31.33K Popularity

15.11K Popularity

10.13K Popularity

2.96K Popularity

6.56K Popularity

7.08K Popularity

7K Popularity

74.13K Popularity

35.28K Popularity

19.51K Popularity

5.19K Popularity

108.93K Popularity

253.67K Popularity

19.87K Popularity

178.66K Popularity

News

View MoreData: 20,000 ETH transferred out from Fidelity Custody, worth approximately $70.16 million

8 m

Data: In the past 24 hours, the entire network has been liquidated for $314 million, with long positions liquidated for $102 million and short positions liquidated for $212 million.

37 m

Data: 424.99 BTC transferred from an anonymous address, routed through a relay, and sent to another anonymous address

38 m

Data: 129.41 BTC transferred out from Ledn, worth approximately $11.6 million

47 m

ETH fell below 2950 USDT

1 h

Pin