IncomeSharks

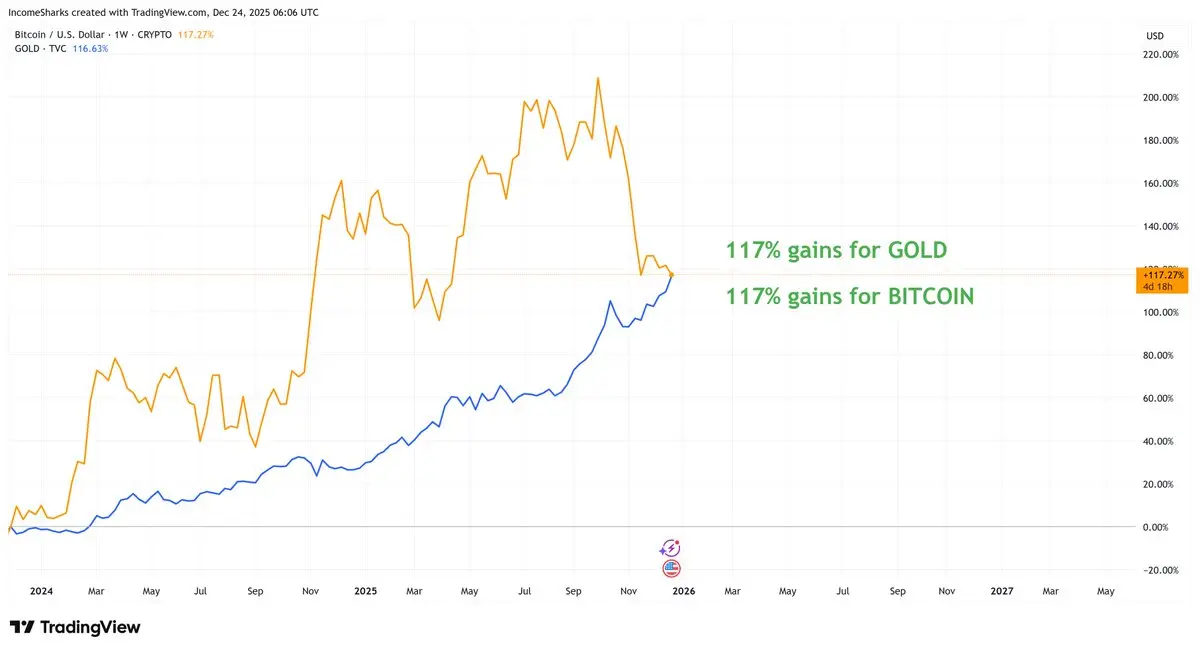

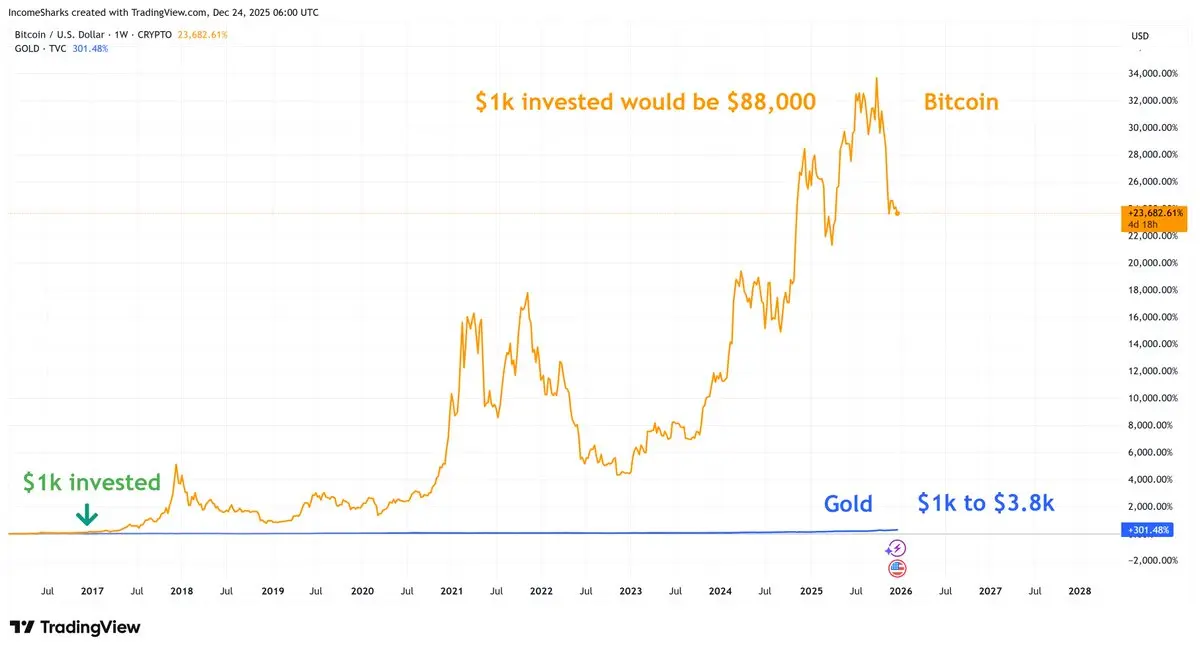

Could argue the most crowded trade right now is being hedged against the US dollar or taking the debasement trade. Over 46 trillion dollars, the most ever, betting against it.

Gold - ATHs this year

Silver - ATHs this year

Bitcoin - ATHs this year

Money Markets - Record high

Gold - ATHs this year

Silver - ATHs this year

Bitcoin - ATHs this year

Money Markets - Record high

BTC-1,12%