SequoiaBlockchain

Good at Spot lying in ambush and short-term medium term contract layout, focusing on short-term trading. I will share my trading strategy irregularly every day, exploring new opportunities in the industry with you. Welcome to follow and communicate.

SequoiaBlockchain

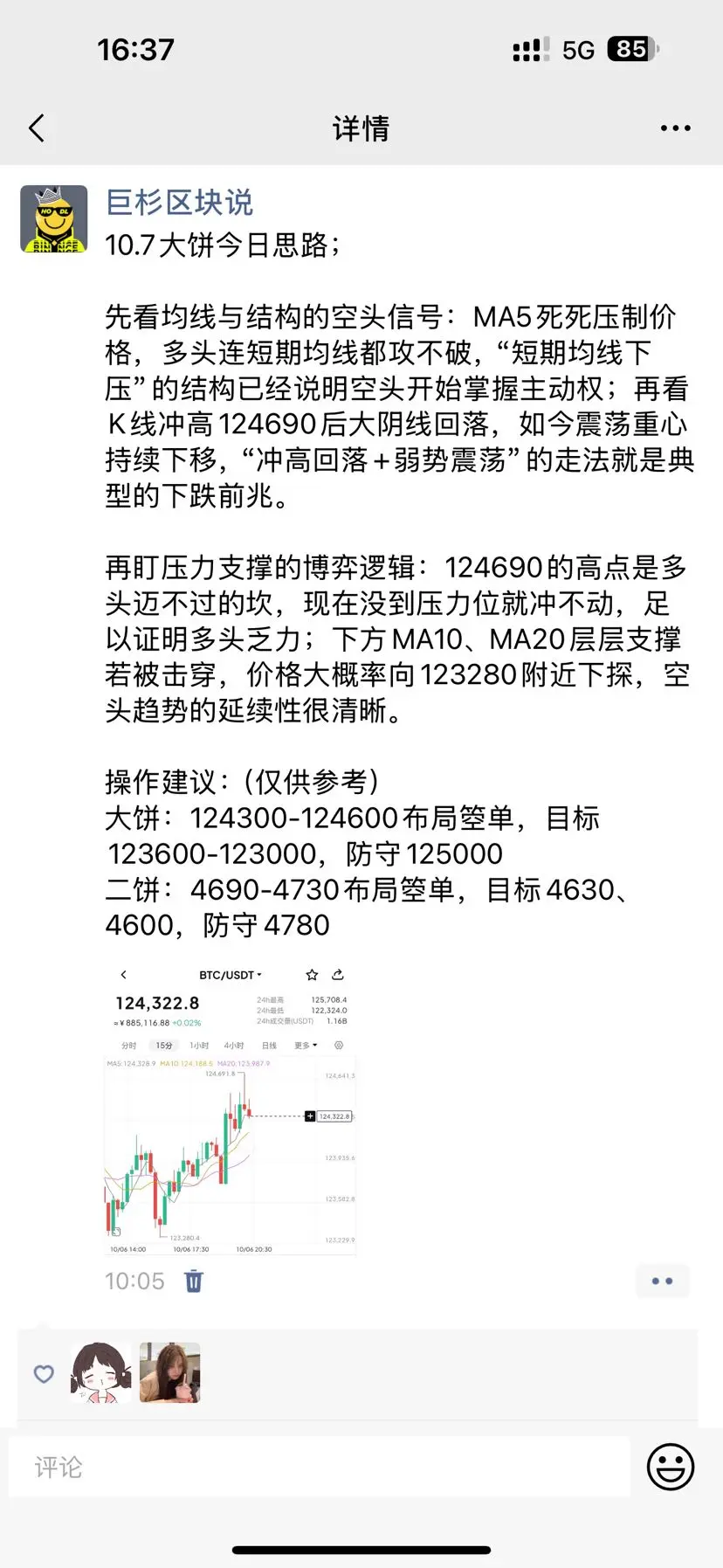

10.7 BTC Strategy:

First, let's look at the moving average level: MA5, MA10, and MA20 show a clear bearish arrangement. The short-term moving averages act like a "bearish wall", firmly suppressing the price. Each rebound is ruthlessly pushed back by the moving averages, and the bulls can't even break through the most basic moving averages, which is enough to illustrate that the short-term trend is completely dominated by the bears.

Looking at the K-line structure again: The downward trend that started from the high point of 126,199.6 has been extremely smooth, with the price continuous

First, let's look at the moving average level: MA5, MA10, and MA20 show a clear bearish arrangement. The short-term moving averages act like a "bearish wall", firmly suppressing the price. Each rebound is ruthlessly pushed back by the moving averages, and the bulls can't even break through the most basic moving averages, which is enough to illustrate that the short-term trend is completely dominated by the bears.

Looking at the K-line structure again: The downward trend that started from the high point of 126,199.6 has been extremely smooth, with the price continuous

BTC-2.44%

- Reward

- like

- 1

- Repost

- Share

鹏宇88 :

:

Is the sol still going long?If the principal is below 1600U, don't rush! Three hardcore logic points on the secret of rolling from 1600U to 38,000U.

First, tell all friends with small capital (below 1500U) to stop treating the crypto world like a casino and blindly messing around. What matters here is not luck, but the strategies and calculations that can help you survive and earn.

I brought a beginner with 1600U starting capital, and in 4 months, it grew to 25,000U. Now the account has broken 38,000U, and there hasn’t been a single liquidation throughout the process; I also went from over 8,000U to financial freedom

View OriginalFirst, tell all friends with small capital (below 1500U) to stop treating the crypto world like a casino and blindly messing around. What matters here is not luck, but the strategies and calculations that can help you survive and earn.

I brought a beginner with 1600U starting capital, and in 4 months, it grew to 25,000U. Now the account has broken 38,000U, and there hasn’t been a single liquidation throughout the process; I also went from over 8,000U to financial freedom

- Reward

- 2

- Comment

- Repost

- Share

10.7 The idea of SOL is as follows:

From a technical perspective, the short-term moving averages of SOL show positive signals, with MA5 and MA10 increasingly converging and trending upwards. The price oscillates around them, and although MA20 is still trending downwards, the bulls have shown significant resistance during the day, with a 24-hour increase of 0.38% demonstrating momentum. At the same time, the daily level has broken through the previous consolidation pattern, and the MACD golden cross continues to gain strength, with clear trend resilience. Each time there is a pullback, it can q

From a technical perspective, the short-term moving averages of SOL show positive signals, with MA5 and MA10 increasingly converging and trending upwards. The price oscillates around them, and although MA20 is still trending downwards, the bulls have shown significant resistance during the day, with a 24-hour increase of 0.38% demonstrating momentum. At the same time, the daily level has broken through the previous consolidation pattern, and the MACD golden cross continues to gain strength, with clear trend resilience. Each time there is a pullback, it can q

SOL-4.95%

- Reward

- like

- Comment

- Repost

- Share

BNB outlook: Strong short-term support, initial momentum for long positions' counterattack, follow the breakthrough of the key resistance level at 1220 #区块链[超话]#

Looking at the moving averages for BNB today, although the short-term MA5, MA10, and MA20 are arranged downward, the price has quickly bounced back up from below the moving averages, showing signs of breaking free from the short-term moving average pressure. Moreover, the price has maintained a +2.56% increase within 24 hours, indicating that long positions still have a certain aggressiveness during the day.

However, it is importa

Looking at the moving averages for BNB today, although the short-term MA5, MA10, and MA20 are arranged downward, the price has quickly bounced back up from below the moving averages, showing signs of breaking free from the short-term moving average pressure. Moreover, the price has maintained a +2.56% increase within 24 hours, indicating that long positions still have a certain aggressiveness during the day.

However, it is importa

BNB7.66%

- Reward

- like

- Comment

- Repost

- Share

10.6 Pancake Ether idea;

On one hand, after the price surged to 124,691.8, it significantly retraced and fell below the MA5. The drop in the past 24 hours from the peak is substantial, indicating a clear weakening of bullish momentum, while bearish forces begin to dominate the short-term trend. If the retracement continues, it is highly likely to test the previous low support level of 123,280.4.

On the other hand, technical indicators also support this judgment: Although the RSI is in a relatively strong zone, the bullish strength is nearing exhaustion, indicating a potential pullback; the MAC

View OriginalOn one hand, after the price surged to 124,691.8, it significantly retraced and fell below the MA5. The drop in the past 24 hours from the peak is substantial, indicating a clear weakening of bullish momentum, while bearish forces begin to dominate the short-term trend. If the retracement continues, it is highly likely to test the previous low support level of 123,280.4.

On the other hand, technical indicators also support this judgment: Although the RSI is in a relatively strong zone, the bullish strength is nearing exhaustion, indicating a potential pullback; the MAC

- Reward

- 1

- 1

- Repost

- Share

Saratau :

:

Hold tight 💪From 50 stop losses to stable profits: Rewrite the "momentum investing" curse with MACD divergence.

When I first started trading contracts, I always chased the price and sold with bearish market, with 50 stop losses in a month, my initial capital of 3000U was reduced to only 800U. It wasn't until the 51st time, when I had a stop loss due to a false breakout, that I realized: blindly following the trend doesn't make money, it just loses capital.

Later I discovered that the divergence of MACD is the key to breaking the deadlock — the price reaches a new high (low), but the MACD doesn'

View OriginalWhen I first started trading contracts, I always chased the price and sold with bearish market, with 50 stop losses in a month, my initial capital of 3000U was reduced to only 800U. It wasn't until the 51st time, when I had a stop loss due to a false breakout, that I realized: blindly following the trend doesn't make money, it just loses capital.

Later I discovered that the divergence of MACD is the key to breaking the deadlock — the price reaches a new high (low), but the MACD doesn'

- Reward

- 1

- Comment

- Repost

- Share

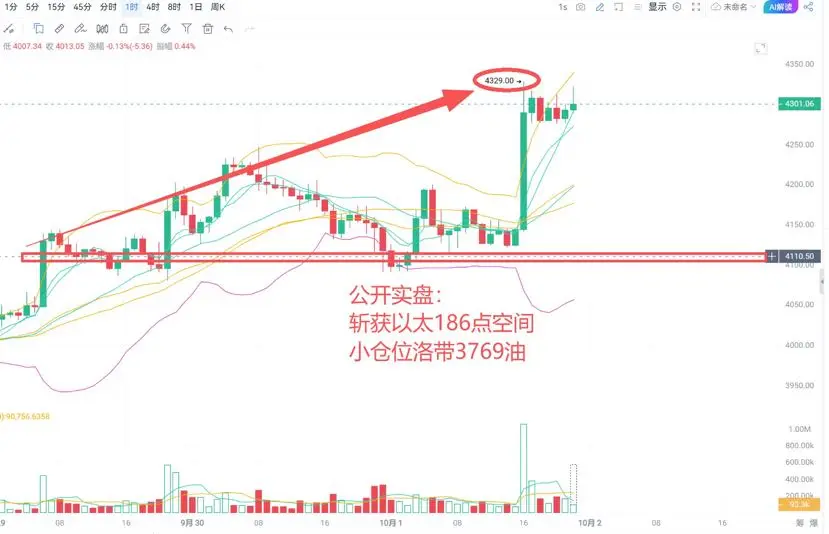

The follow-up to yesterday's public trading is here!

"Some people always say that the giant sequoia analyzes ideas every day, but they don't trade themselves, so what are they analyzing?" - Alright, alright, is that so!

Here it is, the real market has arrived, no flashy operations, no nonsense, just directly going long on Ethereum at the favorable point, openly disclosing positions!

As of now, 186 points of space have been captured, and 3769 oil in Luodai! Swift and straightforward, without any delays!

"Some people always say that the giant sequoia analyzes ideas every day, but they don't trade themselves, so what are they analyzing?" - Alright, alright, is that so!

Here it is, the real market has arrived, no flashy operations, no nonsense, just directly going long on Ethereum at the favorable point, openly disclosing positions!

As of now, 186 points of space have been captured, and 3769 oil in Luodai! Swift and straightforward, without any delays!

ETH-4.67%

- Reward

- like

- Comment

- Repost

- Share

What does ETH think tonight?

Public live trading signals!

The giant sequoia is bullish; the giant sequoia has already entered a long position.

The short-term moving average shows an upward turning trend, which indicates that short-term bullish strength is accumulating, relying on the moving average to move upward, based on today's low long position strategy.

Public live trading signals!

The giant sequoia is bullish; the giant sequoia has already entered a long position.

The short-term moving average shows an upward turning trend, which indicates that short-term bullish strength is accumulating, relying on the moving average to move upward, based on today's low long position strategy.

ETH-4.67%

- Reward

- like

- Comment

- Repost

- Share

9.30 SOL idea;

In the past, every time there was a pullback, it received strong support at the channel support level without breaking it, and then rose again, which shows that the market's buying power is strong and the upward momentum is still abundant.

From a technical perspective, the current price is below the MA5, MA10, and MA20, indicating some short-term pressure. However, the trading volume over the past 24 hours shows that trading activity is relatively good. The focus going forward will be on whether the price can stabilize around 208. If it can stabilize, a rebound is expected;

In the past, every time there was a pullback, it received strong support at the channel support level without breaking it, and then rose again, which shows that the market's buying power is strong and the upward momentum is still abundant.

From a technical perspective, the current price is below the MA5, MA10, and MA20, indicating some short-term pressure. However, the trading volume over the past 24 hours shows that trading activity is relatively good. The focus going forward will be on whether the price can stabilize around 208. If it can stabilize, a rebound is expected;

SOL-4.95%

- Reward

- like

- Comment

- Repost

- Share

9.30 Ether strategy is as follows:

Ether surged from 3966 all the way to 4244, with strong upward momentum. Now it has pulled back to 4192, still up 1.96% over the last 24 hours, showing overall strength.

In terms of moving averages, MA5 and MA10 are above, while MA20 (4171.90) is below as support. If it holds above MA20 in the short term, there is a high probability of a rebound opportunity. If it breaks below, it may test around 4085.

Looking again at the 4-hour level, ETH broke through the previous key high and then pulled back. The support at this point is solid and unbroken, indicating st

Ether surged from 3966 all the way to 4244, with strong upward momentum. Now it has pulled back to 4192, still up 1.96% over the last 24 hours, showing overall strength.

In terms of moving averages, MA5 and MA10 are above, while MA20 (4171.90) is below as support. If it holds above MA20 in the short term, there is a high probability of a rebound opportunity. If it breaks below, it may test around 4085.

Looking again at the 4-hour level, ETH broke through the previous key high and then pulled back. The support at this point is solid and unbroken, indicating st

ETH-4.67%

- Reward

- like

- Comment

- Repost

- Share

9.29 SOL idea:

Although SOL has not effectively broken through the key resistance level, and the RSI is approaching the overbought area, indicating a potential consolidation or even a pullback in the short term, today's price has already shown a decline and is in a slight correction phase.

However, from the perspective of moving averages, MA5, MA10, and MA20 show a short-term bullish arrangement, with MA20 also forming support below. Overall, the short-term trend remains strong, but attention should be paid to the risk of a pullback after the surge. Going forward, it will be important to o

Although SOL has not effectively broken through the key resistance level, and the RSI is approaching the overbought area, indicating a potential consolidation or even a pullback in the short term, today's price has already shown a decline and is in a slight correction phase.

However, from the perspective of moving averages, MA5, MA10, and MA20 show a short-term bullish arrangement, with MA20 also forming support below. Overall, the short-term trend remains strong, but attention should be paid to the risk of a pullback after the surge. Going forward, it will be important to o

SOL-4.95%

- Reward

- like

- Comment

- Repost

- Share

Rollover Trading System: Core Principles + Operating Steps + Pitfall Avoidance Guide

1. Core Principle: The fundamental is to "survive."

Rollover is by no means a gambling technique for quick doubling; rather, it is a system that combines risk control and profit reinvestment. The core logic is "first protect the principal, then earn profits," and the main goal is "not to lose everything" rather than "to earn quickly." Its essence lies in never allowing the money already earned to be taken away by the market. All operations revolve around "capital safety" and "profit locking," rejecting relianc

View Original1. Core Principle: The fundamental is to "survive."

Rollover is by no means a gambling technique for quick doubling; rather, it is a system that combines risk control and profit reinvestment. The core logic is "first protect the principal, then earn profits," and the main goal is "not to lose everything" rather than "to earn quickly." Its essence lies in never allowing the money already earned to be taken away by the market. All operations revolve around "capital safety" and "profit locking," rejecting relianc

- Reward

- like

- Comment

- Repost

- Share

The trend of Ether this time looks more and more like a "replica" of June.

Staring at the K-line of Ether, the more I look, the more I feel it's reenacting the script from June. Don't talk about the possibility of a V-shaped reversal; the market hasn't given any such opportunity at all—if 4060 can't hold, the previous rise will be an obvious false breakout, and it's highly likely we'll follow the old path of 'killing three waves' next.

According to the pattern in June, this wave is meant to completely clean out the leveraged positions, and it wouldn't be sur

Staring at the K-line of Ether, the more I look, the more I feel it's reenacting the script from June. Don't talk about the possibility of a V-shaped reversal; the market hasn't given any such opportunity at all—if 4060 can't hold, the previous rise will be an obvious false breakout, and it's highly likely we'll follow the old path of 'killing three waves' next.

According to the pattern in June, this wave is meant to completely clean out the leveraged positions, and it wouldn't be sur

ETH-4.67%

- Reward

- 1

- Comment

- Repost

- Share

9.26 BTC Strategy:

From the trend perspective, the short-term MA5 and MA10 are consolidating around 109400, with the price oscillating around this level, indicating a clear contest between bulls and bears. However, the upper MA20 (around 110400) creates strong resistance. If the short-term cannot break through this resistance level, the downside risk still exists.

Switching to the four-hour level, after a continuous decline, the price has shown a technical rebound, but the strength of the rebound is constrained by the overall downward trend, failing to reverse the decline, and the market is st

From the trend perspective, the short-term MA5 and MA10 are consolidating around 109400, with the price oscillating around this level, indicating a clear contest between bulls and bears. However, the upper MA20 (around 110400) creates strong resistance. If the short-term cannot break through this resistance level, the downside risk still exists.

Switching to the four-hour level, after a continuous decline, the price has shown a technical rebound, but the strength of the rebound is constrained by the overall downward trend, failing to reverse the decline, and the market is st

BTC-2.44%

- Reward

- like

- Comment

- Repost

- Share