Post content & earn content mining yield

placeholder

LiXiaoyao

129.62M

129.62M

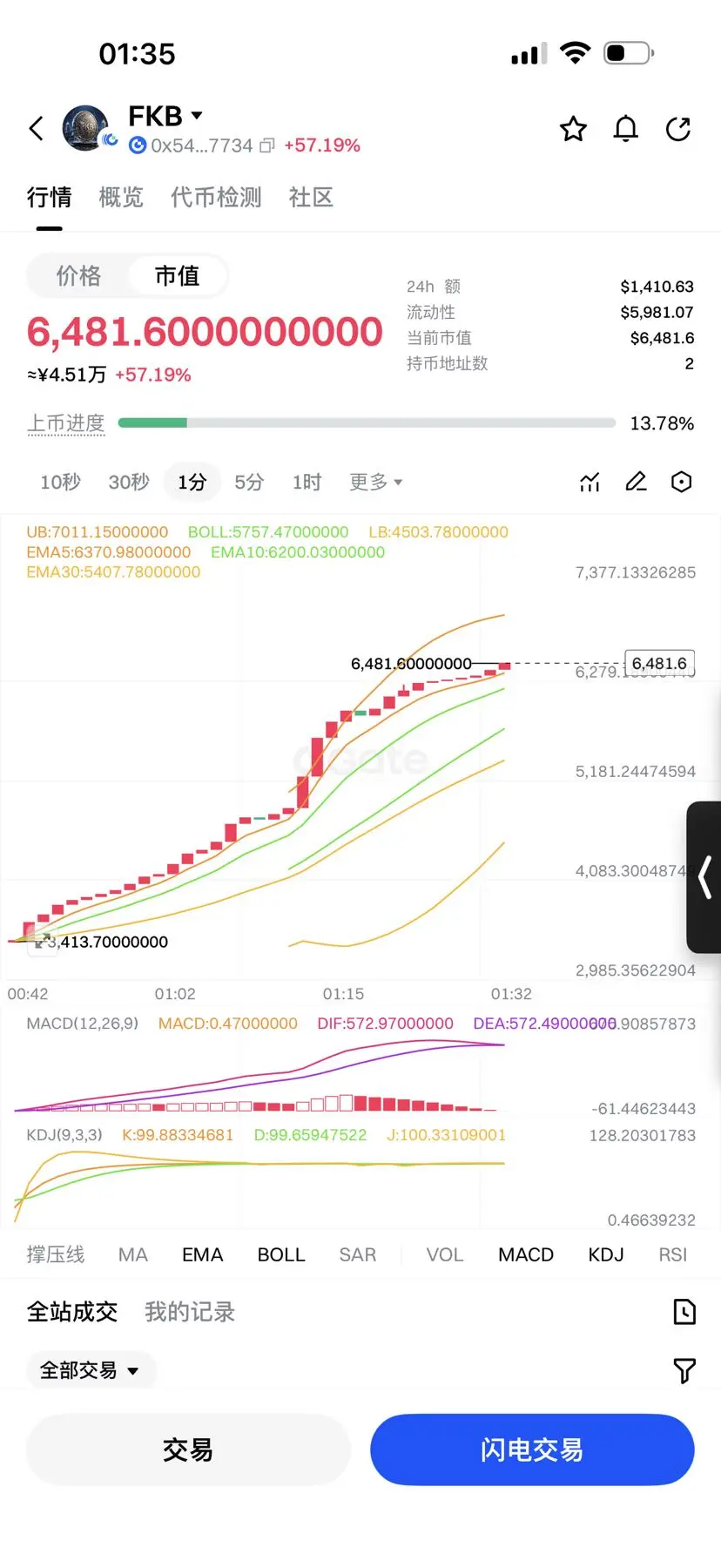

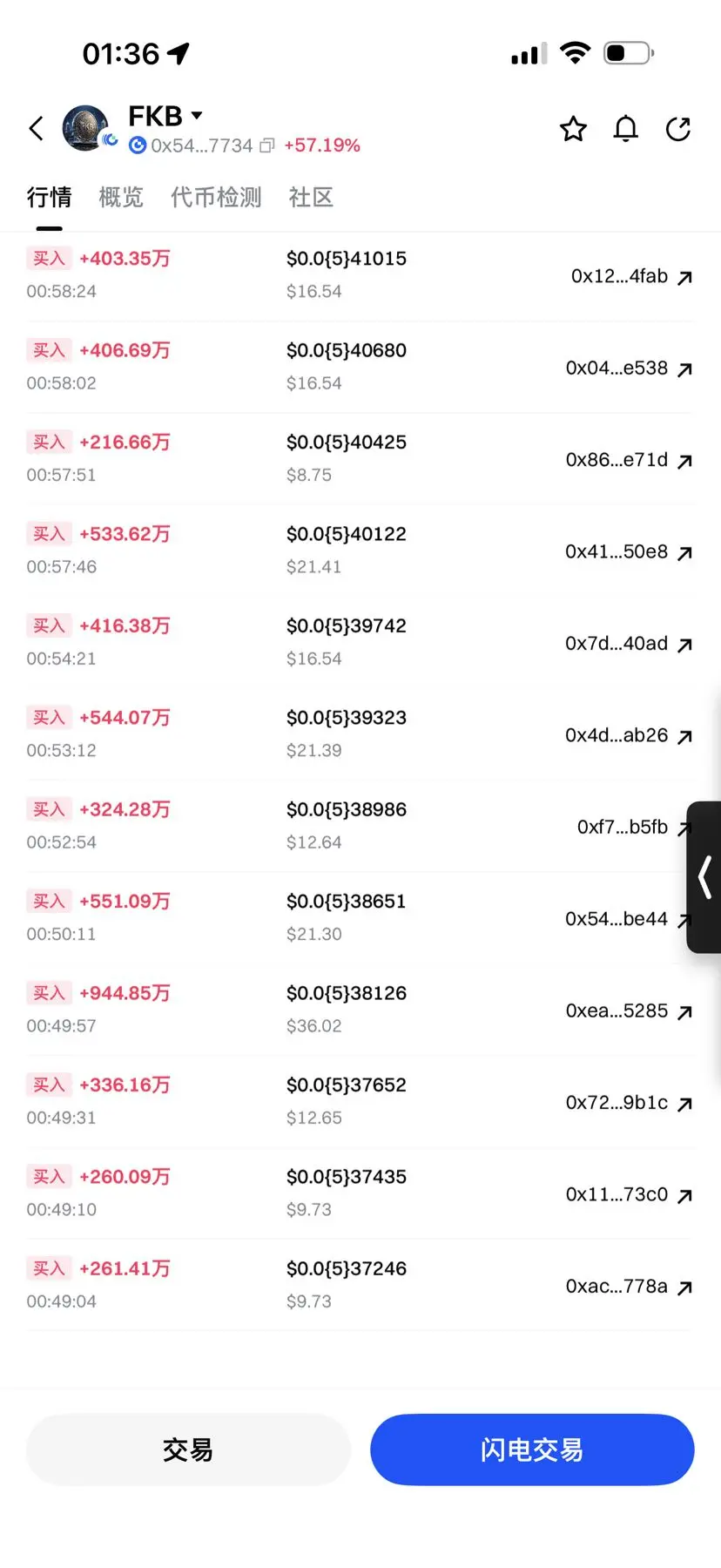

Our fan tokens are performing very healthily. Everyone can buy between 10 to a maximum of 100. Let's all share the consensus and support the listing, brothers.

View Original

MC:$6.57KHolders:2

14.03%

- Reward

- 2

- 1

- Repost

- Share

khanshakib :

:

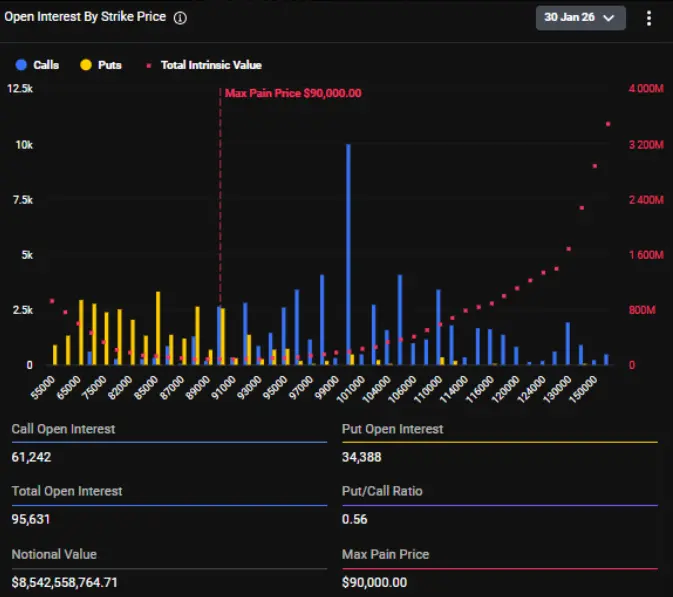

hiThe biggest expiry of 2026 is here. $8.53B at stake.• Max Pain: $90K • Call Walls: $100K • Put Support: $85KPrice is currently the ultimate arbiter of pain. We’ve seen this movie before—expect heavy manipulation into the 8am UTC print.Don\'t get liquidated in the noise. Stay focused.

- Reward

- like

- Comment

- Repost

- Share

#FedRateDecisionApproaches As the Federal Reserve’s interest rate decision approaches, global financial markets are entering a phase of heightened sensitivity and recalibration. This event remains one of the most influential macro catalysts, capable of reshaping capital flows across equities, cryptocurrencies, commodities, bonds, and currency markets simultaneously. In the days leading up to the announcement, positioning often becomes as significant as the decision itself.

Federal Reserve policy directly influences borrowing conditions, liquidity availability, and the pace of economic activity

Federal Reserve policy directly influences borrowing conditions, liquidity availability, and the pace of economic activity

- Reward

- 2

- 1

- Repost

- Share

Peacefulheart :

:

2026 GOGOGO 👊龙马

龙马精神

Created By@ComeWealth,ComeWealth

Subscription Progress

0.00%

MC:

$0

Create My Token

Ethereum Whale Sale: Profit Taking or a Deeper Move?

- Reward

- 4

- 5

- Repost

- Share

Lock_433 :

:

Happy New Year! 🤑View More

🚨 JUST IN: $14T BlackRock says bonds are no longer a safe portfolio hedge. Bitcoin was built for this.

BTC1.89%

- Reward

- like

- Comment

- Repost

- Share

You're in a panic and thinking about what you did wrong, but you're making it worse. Is that how your parents raised you? People who like to mock you, I think you're lacking in discipline.

- Reward

- like

- Comment

- Repost

- Share

🔥Guan Peace, old friends, give me U‼️ Unknowingly, this is the 3rd year since subscribing, and the number of subscribers has also exceeded 280🀄️ The 5.4gt discount is about to end and will revert to 8gt. Friends who subscribe are not fools; if you're not making money, then definitely 😄 click on Apple 👇 or copy the link to subscribe on the web:

https://www.gate.com/zh/profile/Qingquan streams beneath the stones

————————————————

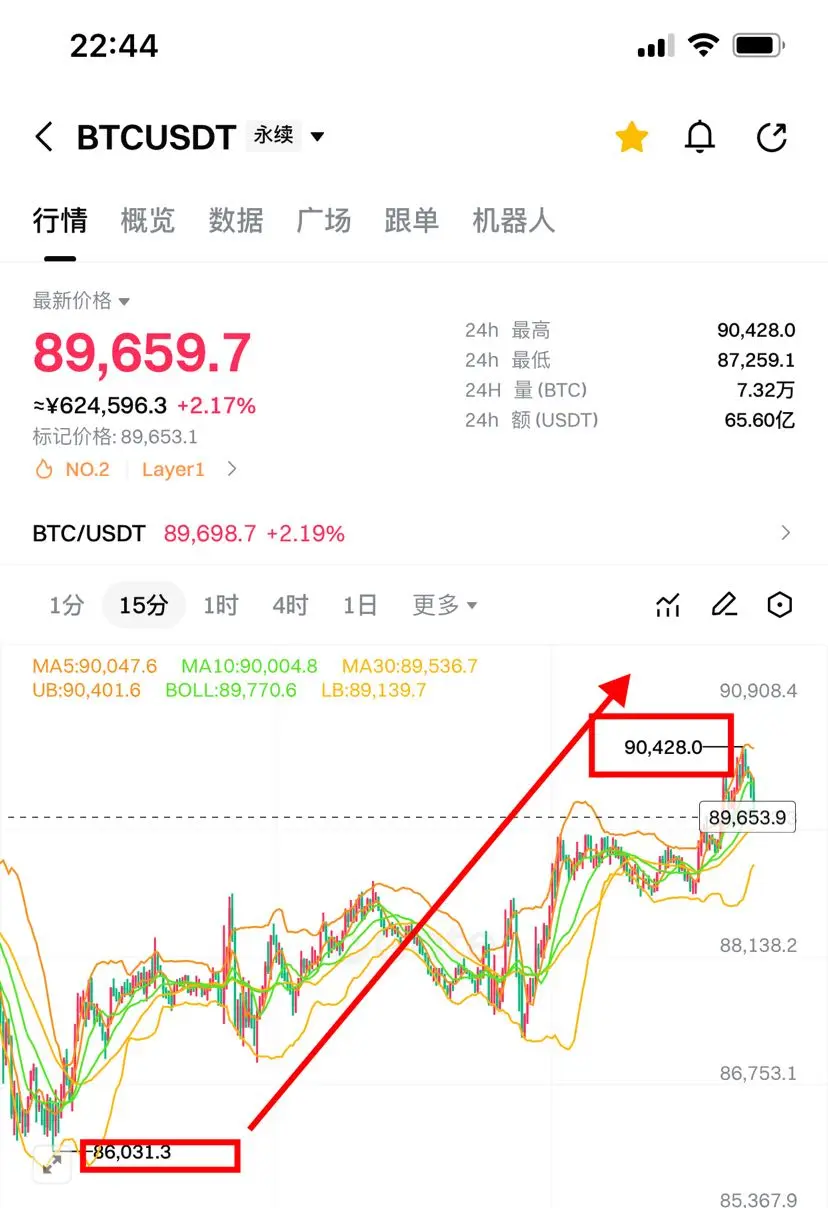

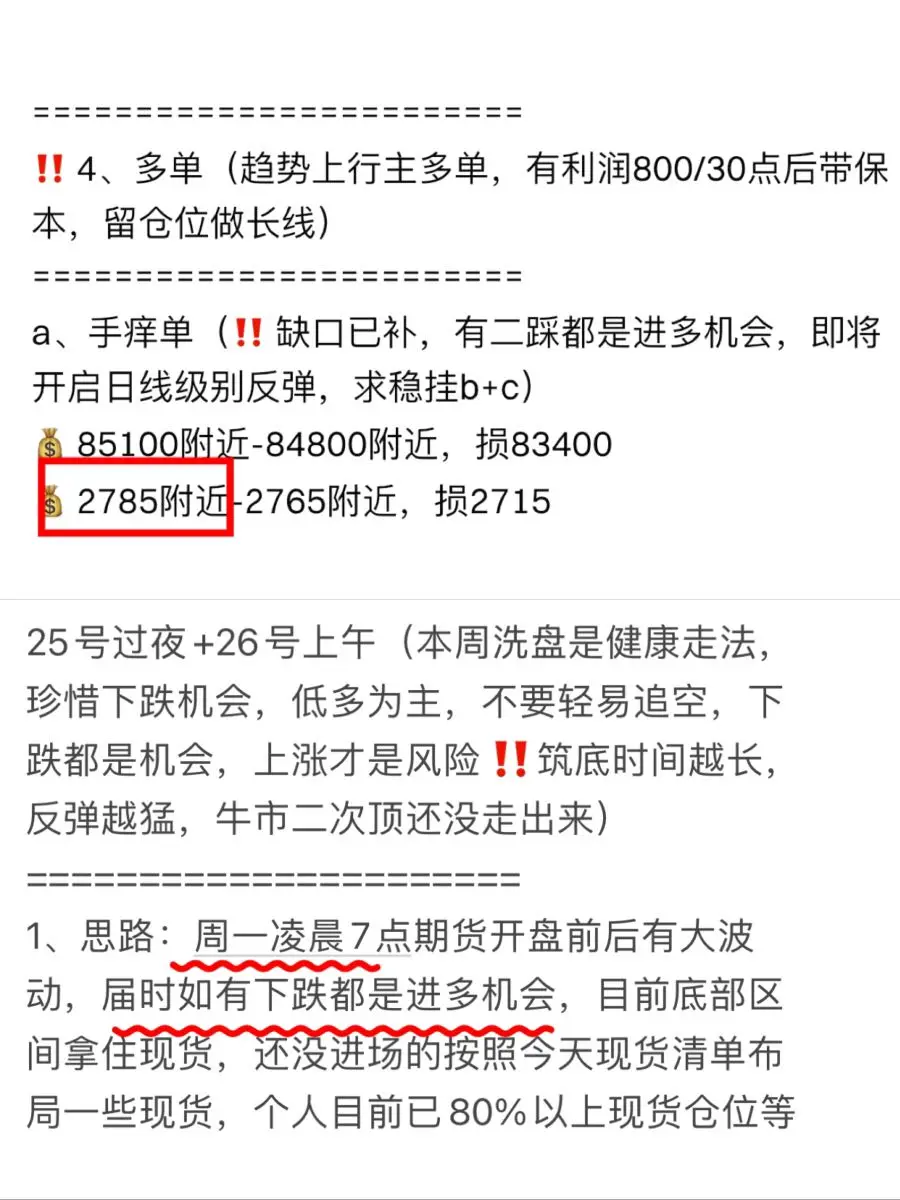

🔥Last week 3400/97800 empty 2865/87250 eating big meat

🔥Late last week 3015/90800 empty Monday 2785/86000 eating more meat

🔥Monday 2785/86000, then 3045/90400, ea

View Originalhttps://www.gate.com/zh/profile/Qingquan streams beneath the stones

————————————————

🔥Last week 3400/97800 empty 2865/87250 eating big meat

🔥Late last week 3015/90800 empty Monday 2785/86000 eating more meat

🔥Monday 2785/86000, then 3045/90400, ea

- Reward

- 10

- 10

- Repost

- Share

KeepUpWithTheRhythmOfTheTimes :

:

Hold on tight, we're about to take off 🛫View More

🚀 Something big is coming!

SincePlus is almost here – your ultimate crypto & social experience.

✨ SincePlus is coming — the future of crypto & social experience.

👉 Visit for more info: sincenetwork pro since-plus

#SincePlus #SinceNetwork

SincePlus is almost here – your ultimate crypto & social experience.

✨ SincePlus is coming — the future of crypto & social experience.

👉 Visit for more info: sincenetwork pro since-plus

#SincePlus #SinceNetwork

- Reward

- like

- Comment

- Repost

- Share

The Federal Reserve will announce its first interest rate decision for 2026 tonight at 3:00! Will the script play out again? The prediction is that rates will most likely remain unchanged, with a dip followed by a rally. Don't bet against the trend; close positions when needed and wait for the direction before entering. Although the market generally expects no rate cut, there will also be statements about future expectations. So tonight is destined to be a sleepless night; staying steady in the face of all changes is the best strategy.

View Original

- Reward

- like

- Comment

- Repost

- Share

#中文Meme币热潮, When all these "harvesting" traders leave, those who can stay are the true kings. Use time to measure value; the future belongs to our Tesla.

MEME0.53%

[The user has shared his/her trading data. Go to the App to view more.]

MC:$30.1KHolders:394

100.00%

- Reward

- like

- Comment

- Repost

- Share

This kid made $100M+ just reviewing toysPeople always say making money today is hardRyan Kaji, better known as Ryan’s World, started YouTube at 3 years oldThe idea of his channel was simple:Open toysPlay with themShow them on cameraToday he’s 13 years old sitting on millions

- Reward

- like

- Comment

- Repost

- Share

扭羊歌

扭羊歌

Created By@GateUser-42fb4747

Subscription Progress

0.00%

MC:

$0

Create My Token

Guavapay Limited Enters Compulsory Liquidation as Official Receiver Takes Control - - #cryptocurrency #bitcoin #altcoins

BTC1.89%

- Reward

- 1

- Comment

- Repost

- Share

Opus 4.5 after knowing some open source model can beat it

- Reward

- like

- Comment

- Repost

- Share

🌹guan Peace, family members of the wheel, giving U‼️ Unknowingly, this is the 4th year since subscribing, and the number of subscribers has also exceeded 280🀄️ The 5.4gt discount is about to end and will revert to 8gt. Friends who subscribe are not fools, if you don’t earn, then definitely 😄. You can click on 👇 or copy it to the web page to subscribe:

https://www.gate.com/zh/profile/When will the autumn rain end

————————————————

🌹 Last week 3400/97800 empty 2865/87250 eating big meat

🌹 Late last week 3015/90800 empty Monday 2785/86000 eating meat again

🌹 Monday 2785/86000, then 3045/904

View Originalhttps://www.gate.com/zh/profile/When will the autumn rain end

————————————————

🌹 Last week 3400/97800 empty 2865/87250 eating big meat

🌹 Late last week 3015/90800 empty Monday 2785/86000 eating meat again

🌹 Monday 2785/86000, then 3045/904

- Reward

- 10

- 10

- Repost

- Share

KeepUpWithTheRhythmOfTheTimes :

:

New Year Wealth Explosion 🤑View More

People were buying the wrong rocks in 2021

- Reward

- like

- Comment

- Repost

- Share

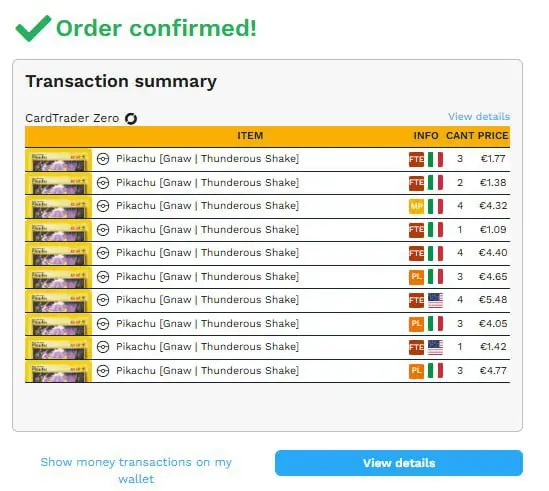

BUY BUY BUY MORE FATPIKA CARDS!!!!⚡️⚡️⚡️⚡️⚡️⚡️+400 CARDS in 6 days ⚡️⚡️⚡️$FATPIKA

- Reward

- like

- Comment

- Repost

- Share

BREAKING:🇺🇸 US Senator has officially called for Trump’s removal from office under the 25th Amendment.

- Reward

- 1

- Comment

- Repost

- Share

I cant believe X is free to use 😂

- Reward

- like

- Comment

- Repost

- Share

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

View More14.55K Popularity

77.55K Popularity

31.36K Popularity

10.75K Popularity

11.3K Popularity

Hot Gate Fun

View More- MC:$0.1Holders:10.00%

- MC:$3.57KHolders:20.60%

- MC:$3.41KHolders:10.00%

- MC:$3.41KHolders:10.00%

- MC:$3.49KHolders:20.00%

News

View MoreMegaETH will launch its public mainnet on February 9.

9 m

The US dollar against the Japanese yen and the euro both fell 1% intraday

1 h

Data: 168 BTC transferred from an anonymous address to Cumberland, worth approximately $13.62 million

1 h

SEC Chair: Discussing regulatory coordination in the crypto space with CFTC tomorrow

1 h

The S&P 500 index fell back to 6,978 points during the trading session, down from over 7,000 points at its high.

1 h

Pin

𝙏𝙤𝙠𝙚𝙣𝙞𝙯𝙚𝙙 𝙍𝙒𝘼𝙨 𝙟𝙪𝙨𝙩 𝙘𝙧𝙤𝙨𝙨𝙚𝙙 $21𝘽 𝙞𝙣 𝙏𝙑𝙇.

-

Long-term forecasts vary — $2–4T by McKinsey, up to $16T per Boston Consulting Group, but directionally, the slope is clear.

© Cryptorank🚨😵💫💥 The $85K Floor: Can Bitcoin Hold Support Amid Sustained ETF Exits ⁉️

While early January 2026 saw a brief "clean slate" recovery, the latest figures suggest institutional caution is back in the driver's seat

📉 What’s happening ⁉️

⚡️Persistent Outflows: Following a massive $1.73 billion weekly exit in late January, the trend remains shaky. Even brief "green" days (like the $6.8M inflow on Jan 26) are pale compared to the billions lost in late 2025

⚡️Price Pressure: Outflows often act as a "sell signal" for the broader market, as they represent institutional de-risking

🔍 What does thThe U.S. crypto market has witnessed a significant internal rift as of late January 2026, with industry giants Ripple and Coinbase taking opposing stances on the newly amended CLARITY Act.

WHAT'S THE WAY FORWARD FOR BITCOIN?

PUMPING OR DUMPING SOON ? FIND OUT HERE:

As of January 27, 2026, Bitcoin ($BTC ) is trading around $87,700 - $88,600 (With a live price of $88,300 at the time of writing) showing signs of consolidation after recent volatility. The cryptocurrency has been under pressure from macroeconomic factors, geopolitical tensions (such as U.S.-Iran issues), and market rotations away from risk assets. This has led to a choppy trading environment, with BTC struggling to reclaim higher levels like $90,000 while defending key supports. Short-Term Price Movement (1-30 DGate Square New & Returning Creator Rewards are ongoing!

Your ideas may be more valuable than you think!

Make your first post or come back post to share a $20,000 monthly prize pool!

Post with #MyFirstPostOnSquare to receive a $50 Position Voucher each

Monthly Top Posters and Top Engagers will each earn an extra $50 reward

Your crypto insights could inspire many—start creating today!

👉 https://www.gate.com/post