# FedRateDecisionApproaches

8.96K

No rate cut is expected, but the Fed’s tone—hawkish or dovish—could still move Bitcoin. What’s your read on this meeting? Will Powell stay tough or soften his stance?

MingDragonX

#FedRateDecisionApproaches the Federal Reserve’s upcoming decision may act less as a conclusion and more as a directional signal that shapes market behavior well into the next quarter. Even if rates remain unchanged, the framing around inflation progress, economic resilience, and policy flexibility will influence how capital allocates across risk and defensive assets. Markets are increasingly forward-looking, meaning reactions will be driven by what the Fed implies about the next move rather than the present one. This creates an environment where expectations, not certainty, dominate price di

- Reward

- 2

- 1

- Repost

- Share

Yunna :

:

buy to earn#FedRateDecisionApproaches 🚨

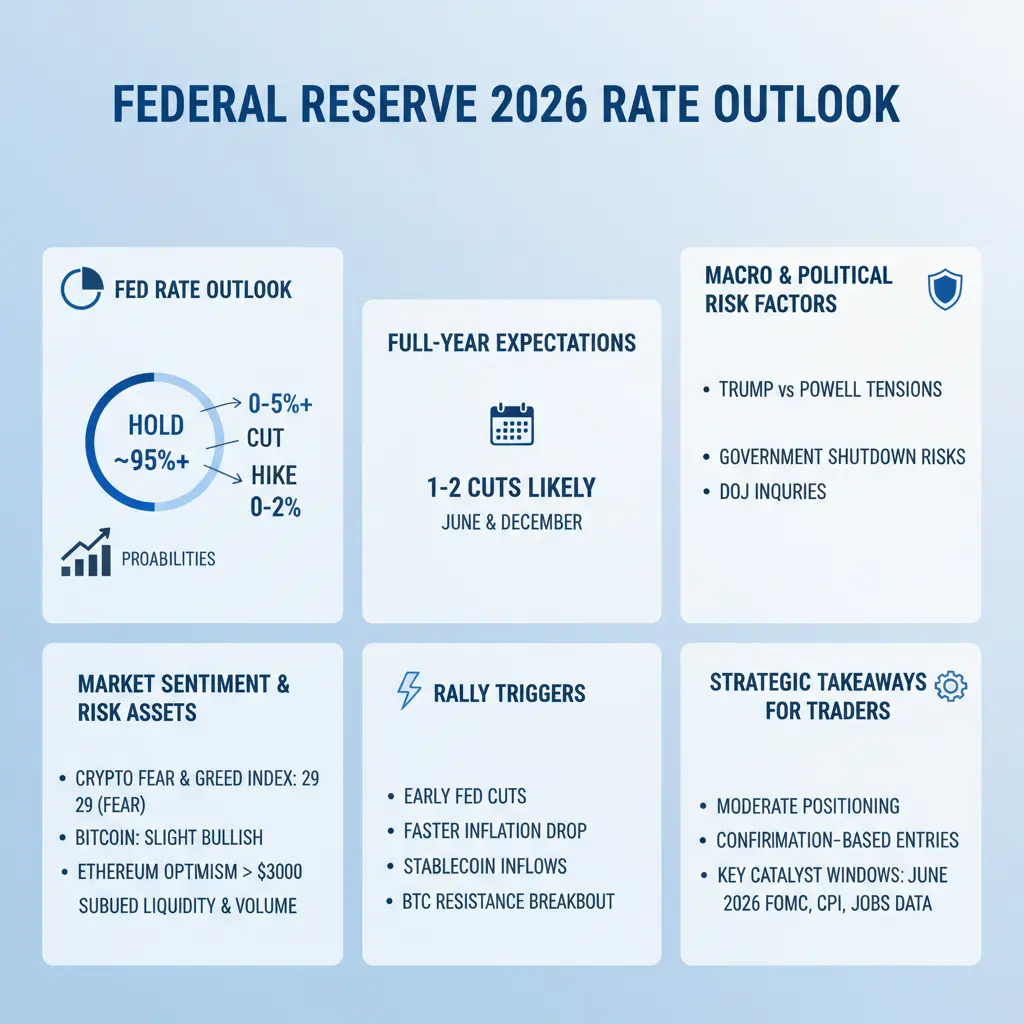

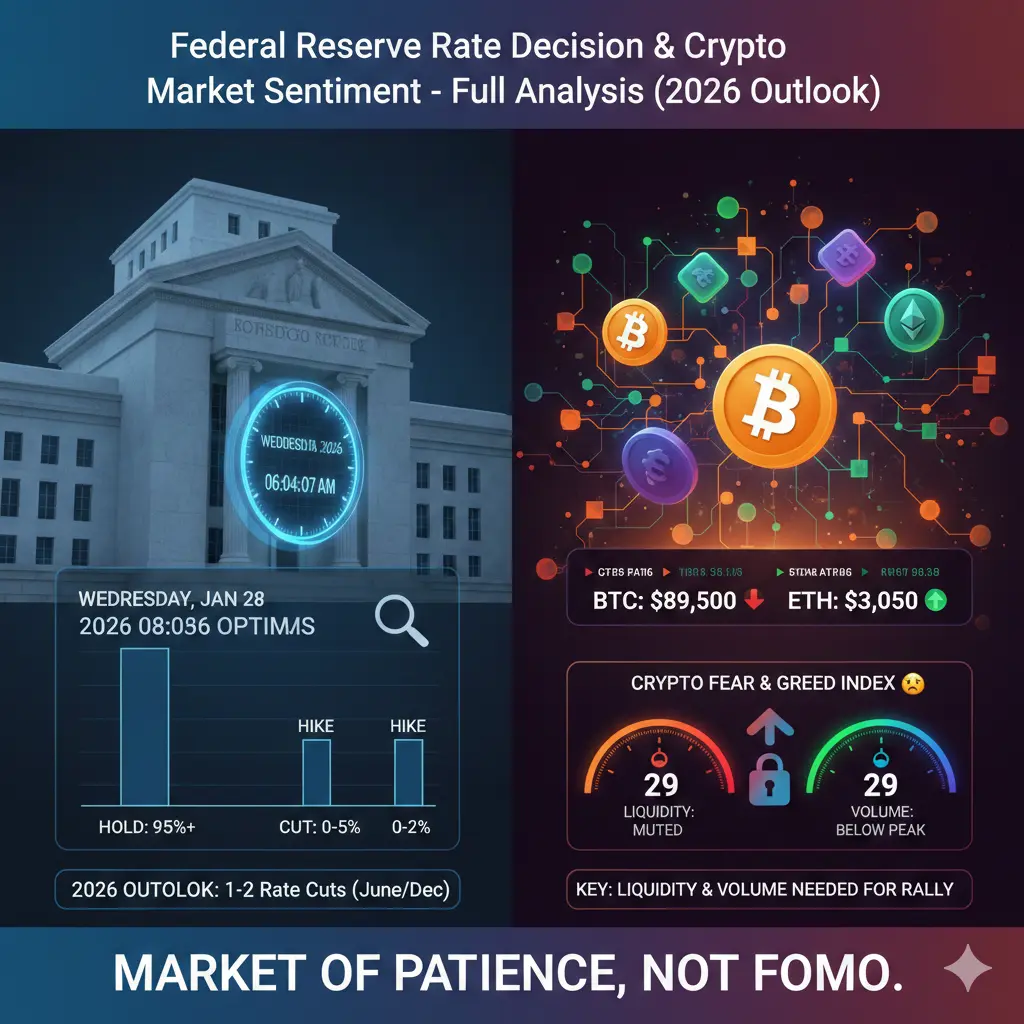

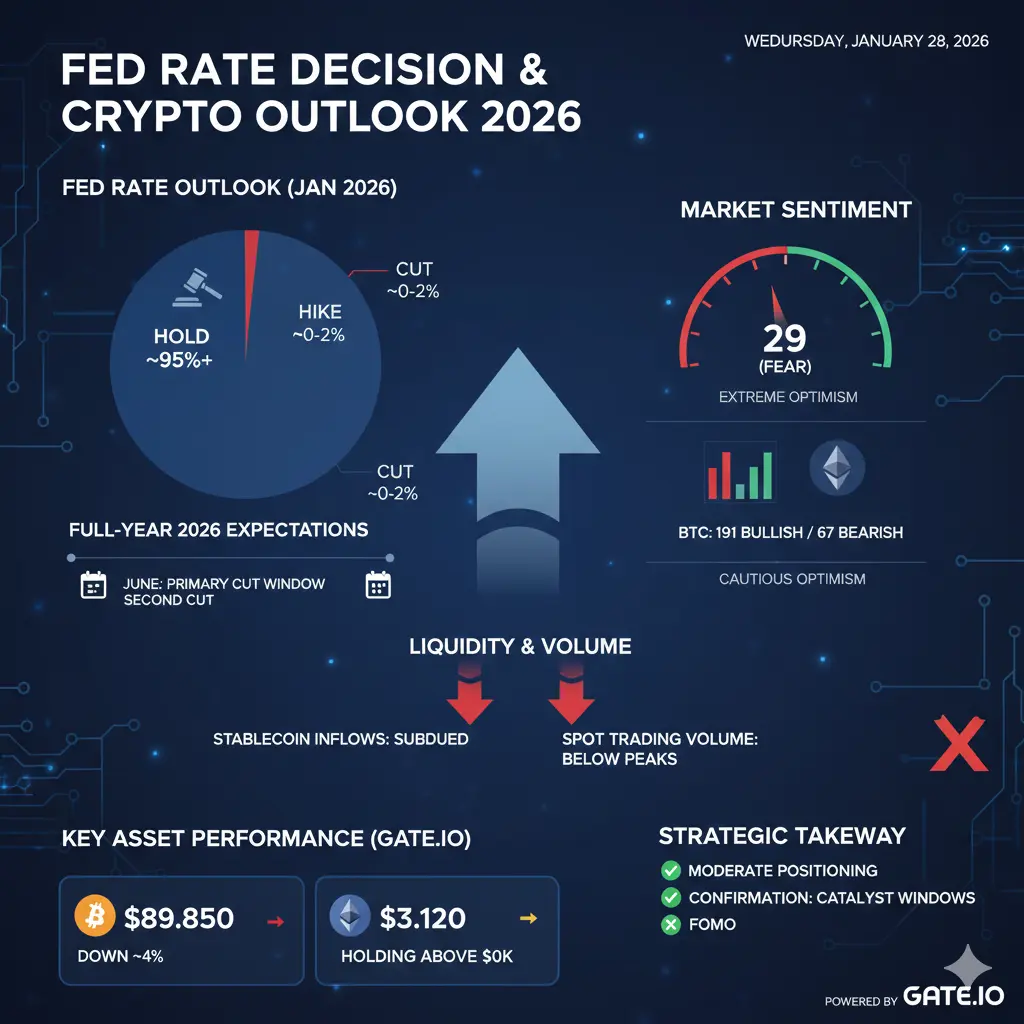

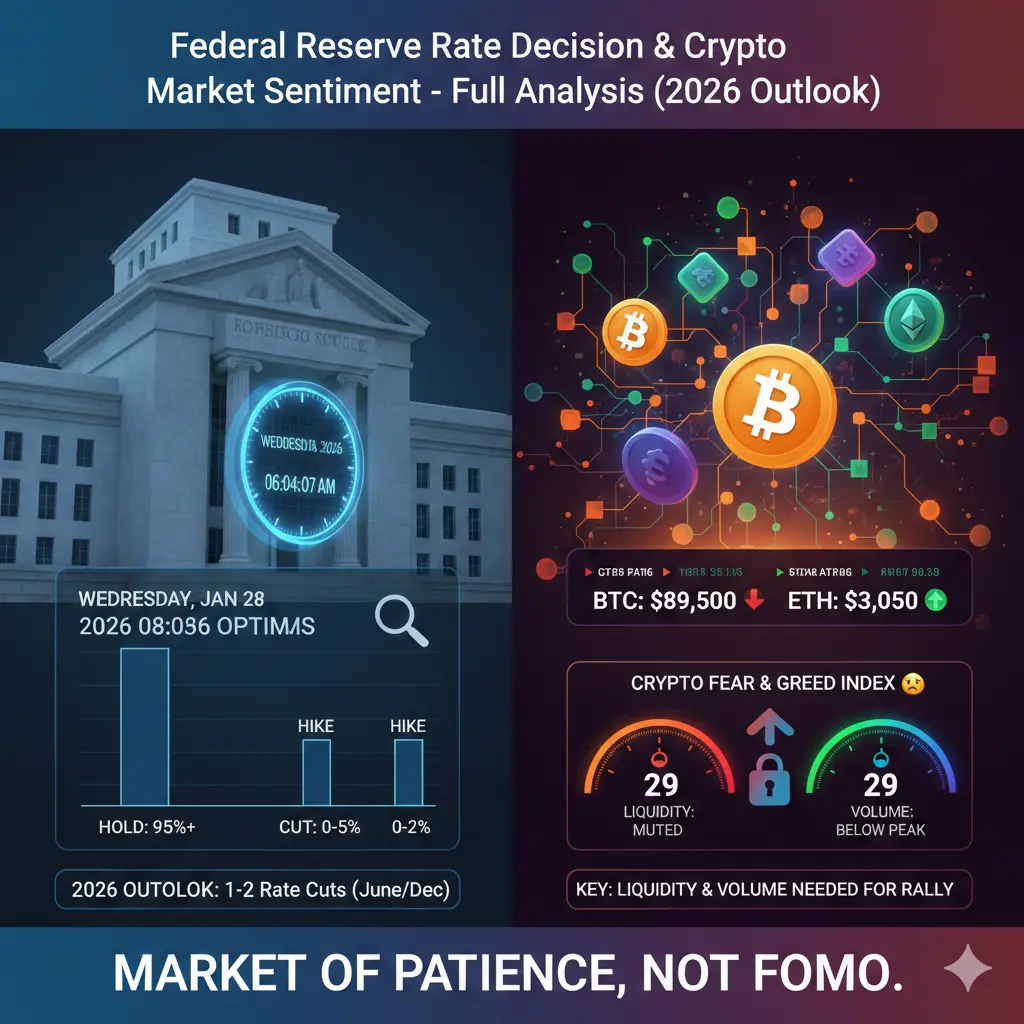

The Federal Reserve’s interest rate decision this Wednesday is widely expected to remain on hold, with markets assigning near-zero probability to an immediate hike or cut.

After three cuts at the end of 2025, the benchmark rate sits at 3.50%–3.75%, and policymakers are cautious as they monitor inflation stability and labor market strength.

📊 Fed Rate Outlook (2026)

This Meeting:

Hold probability: ~95%+

Rate cut probability: ~0–5%

Rate hike probability: ~0–2%

Full-Year Expectations: 1–2 rate cuts likely, primarily in June 2026, with a possible second cut in Decemb

The Federal Reserve’s interest rate decision this Wednesday is widely expected to remain on hold, with markets assigning near-zero probability to an immediate hike or cut.

After three cuts at the end of 2025, the benchmark rate sits at 3.50%–3.75%, and policymakers are cautious as they monitor inflation stability and labor market strength.

📊 Fed Rate Outlook (2026)

This Meeting:

Hold probability: ~95%+

Rate cut probability: ~0–5%

Rate hike probability: ~0–2%

Full-Year Expectations: 1–2 rate cuts likely, primarily in June 2026, with a possible second cut in Decemb

- Reward

- 4

- 8

- Repost

- Share

CryptoChampion :

:

DYOR 🤓View More

🧭 Gold Breaks $5,000 as Geopolitical Risk Spikes — Is This the Moment to Hedge or Hunt a BTC Dip?

Escalating U.S.–Iran tensions have flipped global markets into risk-off mode. Capital is rotating fast — and the divergence between gold and Bitcoin is getting louder.

🥇 Gold: Fear Trade in Full Control

Gold pushing above the $5,000 level is not a normal technical breakout — it’s a macro statement.

What’s driving it right now:

Heightened geopolitical risk → classic safe-haven demand

Weak confidence in fiat stability during conflict escalation

Central banks & institutions prioritizing capital pre

Escalating U.S.–Iran tensions have flipped global markets into risk-off mode. Capital is rotating fast — and the divergence between gold and Bitcoin is getting louder.

🥇 Gold: Fear Trade in Full Control

Gold pushing above the $5,000 level is not a normal technical breakout — it’s a macro statement.

What’s driving it right now:

Heightened geopolitical risk → classic safe-haven demand

Weak confidence in fiat stability during conflict escalation

Central banks & institutions prioritizing capital pre

BTC1.9%

- Reward

- 11

- 5

- Repost

- Share

neesa04 :

:

Watching Closely 🔍️View More

#FedRateDecisionApproaches

The upcoming Federal Reserve interest rate decision this Wednesday is widely expected to result in no rate change, with financial markets assigning near-zero probability to a surprise rate hike or immediate rate cut.

After three rate cuts at the end of 2025, the current benchmark interest rate sits around 3.50%–3.75%, and policymakers remain cautious as they evaluate inflation stability and labor market strength.

🏦 Fed Rate Outlook & Rate Cut Probabilities (2026)

Short-Term Outlook (This Meeting):

Rate cut probability: ~0–5%

Rate hike probability: ~0–2%

Hold probab

The upcoming Federal Reserve interest rate decision this Wednesday is widely expected to result in no rate change, with financial markets assigning near-zero probability to a surprise rate hike or immediate rate cut.

After three rate cuts at the end of 2025, the current benchmark interest rate sits around 3.50%–3.75%, and policymakers remain cautious as they evaluate inflation stability and labor market strength.

🏦 Fed Rate Outlook & Rate Cut Probabilities (2026)

Short-Term Outlook (This Meeting):

Rate cut probability: ~0–5%

Rate hike probability: ~0–2%

Hold probab

BLESS2.96%

- Reward

- 15

- 14

- Repost

- Share

GateUser-68291371 :

:

Vibe at 1000x 🤑View More

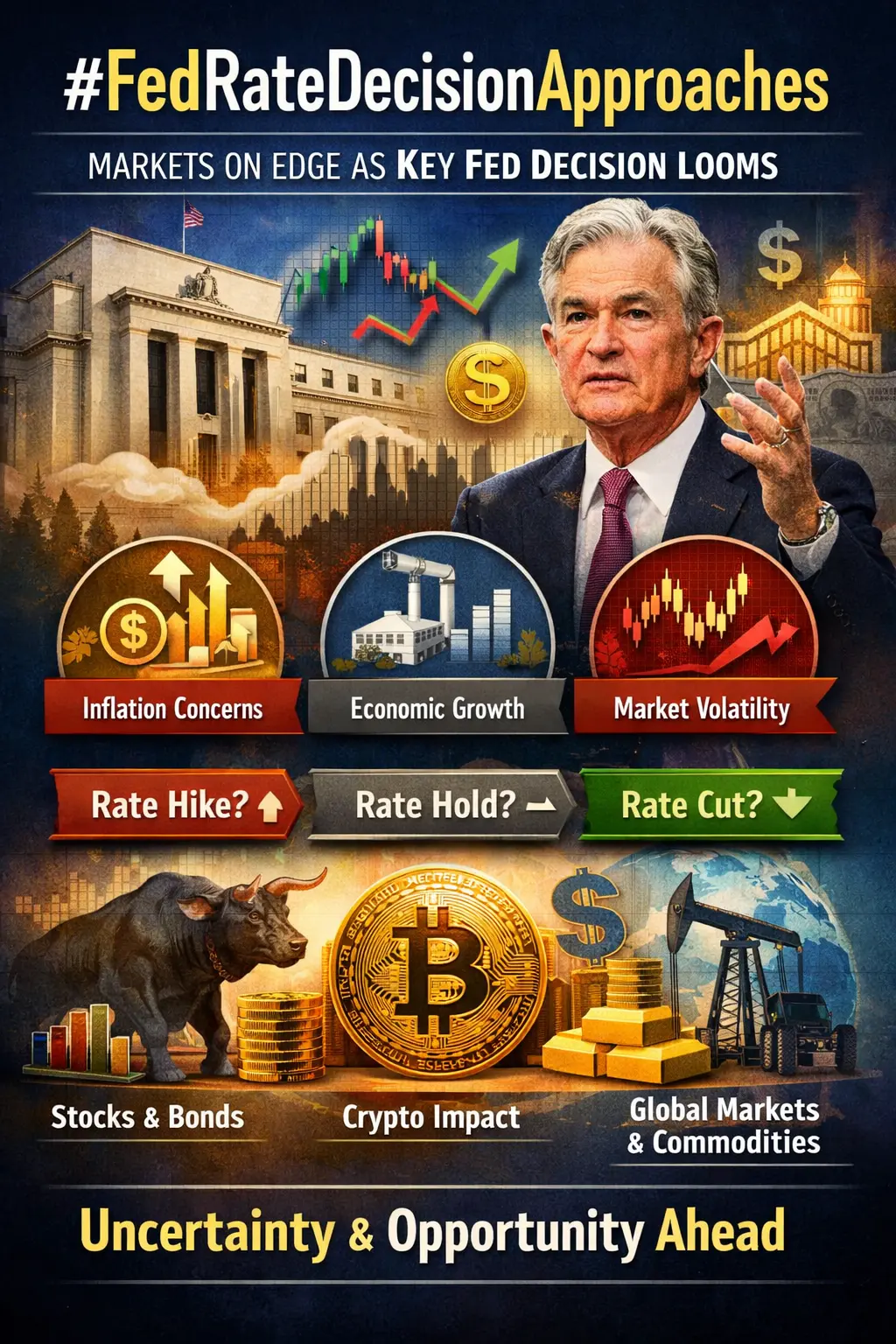

#FedRateDecisionApproaches As the Federal Reserve’s interest rate decision draws closer, global financial markets are entering a period of heightened sensitivity and recalibration. This event remains one of the most powerful macroeconomic catalysts, capable of influencing capital flows across equities, cryptocurrencies, commodities, bonds, and currency markets simultaneously. In the days leading up to the decision, positioning often becomes as important as the outcome itself.

The Federal Reserve’s policy direction directly affects borrowing costs, liquidity availability, and overall economic m

The Federal Reserve’s policy direction directly affects borrowing costs, liquidity availability, and overall economic m

- Reward

- 12

- 7

- Repost

- Share

ybaser :

:

2026 Go Go Go 👊View More

#FedRateDecisionApproaches

No rate cut expected, but the real move will come from Powell’s tone.

Hawkish words can pressure BTC even without policy change.

Dovish hints could quickly flip risk appetite back on.

I’m watching DXY, yields, and BTC reaction during the speech — not the headline.

Sometimes the market moves more on language than decisions.

Do you expect Powell to stay tough, or signal a softer path ahead?

No rate cut expected, but the real move will come from Powell’s tone.

Hawkish words can pressure BTC even without policy change.

Dovish hints could quickly flip risk appetite back on.

I’m watching DXY, yields, and BTC reaction during the speech — not the headline.

Sometimes the market moves more on language than decisions.

Do you expect Powell to stay tough, or signal a softer path ahead?

BTC1.9%

- Reward

- 15

- 21

- Repost

- Share

xxx40xxx :

:

2026 GOGOGO 👊View More

#FedRateDecisionApproaches

As the Federal Reserve’s next interest rate decision approaches, global financial markets are entering a phase of heightened anticipation and uncertainty.

Investors, traders, and policymakers are all watching closely, not just for the decision itself, but for the tone, language, and forward guidance that will shape market expectations for the coming months. In today’s interconnected financial system, a single Fed announcement can send ripples through equities, bonds, commodities, cryptocurrencies, and emerging markets around the world.

The Federal Reserve’s interest

As the Federal Reserve’s next interest rate decision approaches, global financial markets are entering a phase of heightened anticipation and uncertainty.

Investors, traders, and policymakers are all watching closely, not just for the decision itself, but for the tone, language, and forward guidance that will shape market expectations for the coming months. In today’s interconnected financial system, a single Fed announcement can send ripples through equities, bonds, commodities, cryptocurrencies, and emerging markets around the world.

The Federal Reserve’s interest

BTC1.9%

- Reward

- 6

- 7

- Repost

- Share

MissCrypto :

:

Watching Closely 🔍️View More

#FedRateDecisionApproaches

As the Federal Reserve’s interest rate decision approaches, global financial markets are entering a critical phase of anticipation and recalibration. This event is one of the most influential macroeconomic catalysts, with far-reaching implications across equities, cryptocurrencies, commodities, bonds, and currency markets. Below is a comprehensive, point-by-point explanation of why this decision matters and how investors are positioning ahead of it.

1. Significance of the Federal Reserve’s Decision

The Federal Reserve’s policy rate directly influences borrowing cost

As the Federal Reserve’s interest rate decision approaches, global financial markets are entering a critical phase of anticipation and recalibration. This event is one of the most influential macroeconomic catalysts, with far-reaching implications across equities, cryptocurrencies, commodities, bonds, and currency markets. Below is a comprehensive, point-by-point explanation of why this decision matters and how investors are positioning ahead of it.

1. Significance of the Federal Reserve’s Decision

The Federal Reserve’s policy rate directly influences borrowing cost

- Reward

- 11

- 14

- Repost

- Share

Ryakpanda :

:

2026 Go Go Go 👊View More

#FedRateDecisionApproaches 🚨

Markets are tightening up as the Federal Reserve decision comes into focus. This is the zone where positioning matters more than prediction — liquidity thins, volatility builds, and reactions get exaggerated.

Rate decisions don’t operate in isolation. They ripple across: • Equities and risk assets

• Crypto volatility and BTC dominance

• Gold’s safe-haven demand

• Dollar strength and global capital flows

Possible paths: 🔹 Hawkish tone → pressure on risk assets, defensive positioning

🔹 Dovish hints → liquidity relief and renewed momentum

This isn’t a moment for im

Markets are tightening up as the Federal Reserve decision comes into focus. This is the zone where positioning matters more than prediction — liquidity thins, volatility builds, and reactions get exaggerated.

Rate decisions don’t operate in isolation. They ripple across: • Equities and risk assets

• Crypto volatility and BTC dominance

• Gold’s safe-haven demand

• Dollar strength and global capital flows

Possible paths: 🔹 Hawkish tone → pressure on risk assets, defensive positioning

🔹 Dovish hints → liquidity relief and renewed momentum

This isn’t a moment for im

BTC1.9%

- Reward

- 9

- 11

- Repost

- Share

HighAmbition :

:

2026 GOGOGO 👊View More

#FedRateDecisionApproaches

As the Federal Reserve’s policy meeting draws closer, global markets are entering a high-sensitivity phase where expectations matter more than the decision itself.

At this stage, markets are largely pricing in a rate hold, reflecting the Fed’s continued focus on inflation control and data-dependence. However, the real market driver will not be the headline rate — it will be forward guidance, tone, and projections.

Why This Decision Matters

Interest rates sit at the core of global asset valuation. Whether it’s equities, bonds, crypto, or commodities, liquidity expecta

As the Federal Reserve’s policy meeting draws closer, global markets are entering a high-sensitivity phase where expectations matter more than the decision itself.

At this stage, markets are largely pricing in a rate hold, reflecting the Fed’s continued focus on inflation control and data-dependence. However, the real market driver will not be the headline rate — it will be forward guidance, tone, and projections.

Why This Decision Matters

Interest rates sit at the core of global asset valuation. Whether it’s equities, bonds, crypto, or commodities, liquidity expecta

- Reward

- 7

- 9

- Repost

- Share

HighAmbition :

:

2026 GOGOGO 👊View More

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

6.68K Popularity

68.44K Popularity

23.18K Popularity

9.36K Popularity

8.96K Popularity

8.24K Popularity

7.65K Popularity

6.77K Popularity

73.84K Popularity

20.27K Popularity

81.73K Popularity

23.21K Popularity

49.43K Popularity

43.52K Popularity

196.35K Popularity

News

View MoreJustLend DAO TVL surpasses $6.71 billion threshold

1 m

Gate ETF will launch RIVER3L and RIVER3S, participate in the new coin challenge and share 30,000 USDT

2 m

Mirae Asset Global Investments 增持 8.7 万股 MSTR,价值 1410 万美元

5 m

Da Hongfei: Focus on asset onboarding and application development, empowering NEO and GAS

7 m

An address has invested nearly $100,000 to bet on the California 2026 election passing a billionaire one-time wealth tax.

8 m

Pin

𝙏𝙤𝙠𝙚𝙣𝙞𝙯𝙚𝙙 𝙍𝙒𝘼𝙨 𝙟𝙪𝙨𝙩 𝙘𝙧𝙤𝙨𝙨𝙚𝙙 $21𝘽 𝙞𝙣 𝙏𝙑𝙇.

-

Long-term forecasts vary — $2–4T by McKinsey, up to $16T per Boston Consulting Group, but directionally, the slope is clear.

© Cryptorank🚨😵💫💥 The $85K Floor: Can Bitcoin Hold Support Amid Sustained ETF Exits ⁉️

While early January 2026 saw a brief "clean slate" recovery, the latest figures suggest institutional caution is back in the driver's seat

📉 What’s happening ⁉️

⚡️Persistent Outflows: Following a massive $1.73 billion weekly exit in late January, the trend remains shaky. Even brief "green" days (like the $6.8M inflow on Jan 26) are pale compared to the billions lost in late 2025

⚡️Price Pressure: Outflows often act as a "sell signal" for the broader market, as they represent institutional de-risking

🔍 What does thThe U.S. crypto market has witnessed a significant internal rift as of late January 2026, with industry giants Ripple and Coinbase taking opposing stances on the newly amended CLARITY Act.

WHAT'S THE WAY FORWARD FOR BITCOIN?

PUMPING OR DUMPING SOON ? FIND OUT HERE:

As of January 27, 2026, Bitcoin ($BTC ) is trading around $87,700 - $88,600 (With a live price of $88,300 at the time of writing) showing signs of consolidation after recent volatility. The cryptocurrency has been under pressure from macroeconomic factors, geopolitical tensions (such as U.S.-Iran issues), and market rotations away from risk assets. This has led to a choppy trading environment, with BTC struggling to reclaim higher levels like $90,000 while defending key supports. Short-Term Price Movement (1-30 DGate Square New & Returning Creator Rewards are ongoing!

Your ideas may be more valuable than you think!

Make your first post or come back post to share a $20,000 monthly prize pool!

Post with #MyFirstPostOnSquare to receive a $50 Position Voucher each

Monthly Top Posters and Top Engagers will each earn an extra $50 reward

Your crypto insights could inspire many—start creating today!

👉 https://www.gate.com/post