$1.65 Trillion on Ice—Bitcoin Struggles to Shake off the Bears

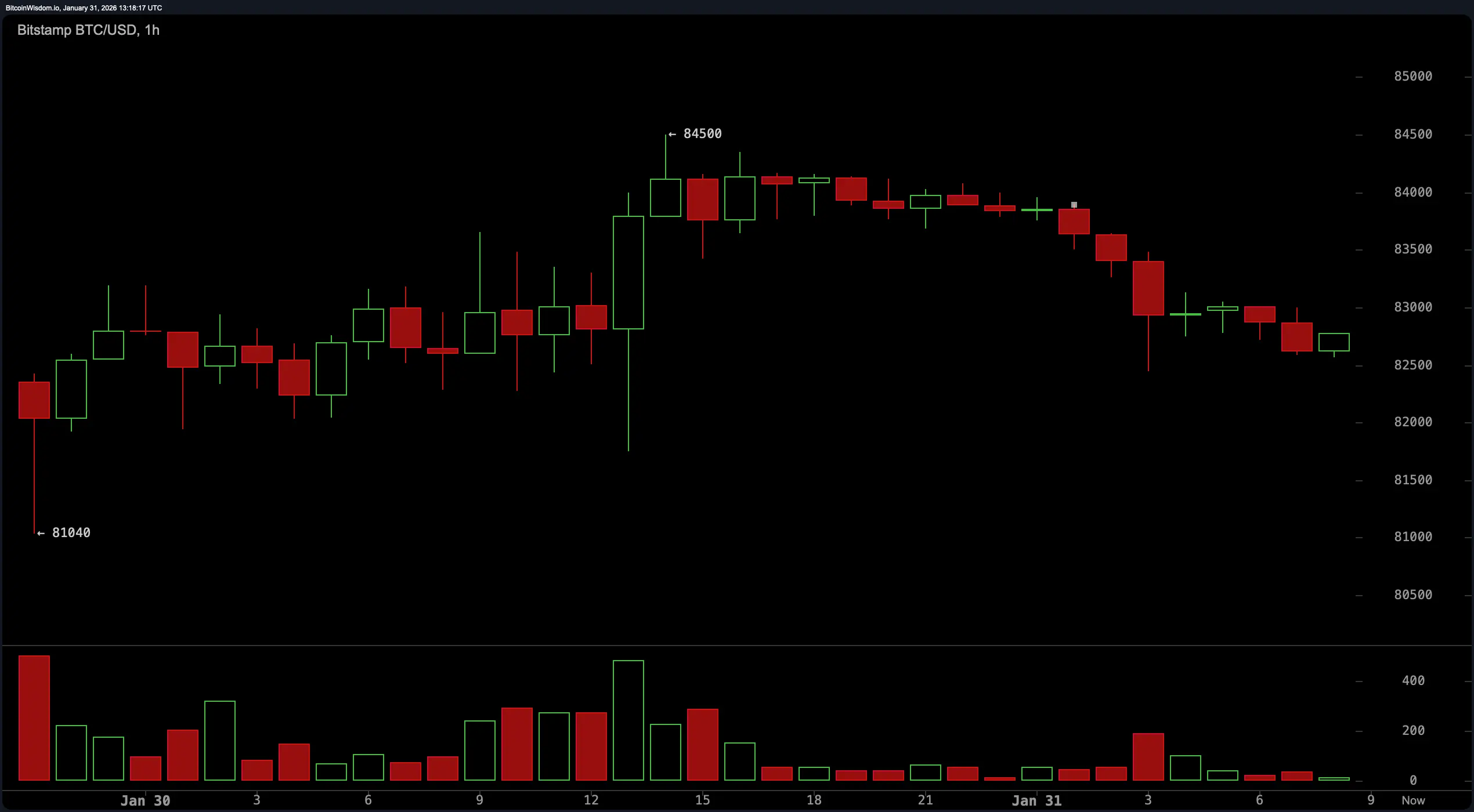

Bitcoin entered Saturday, Jan. 31, 2026, with a bruised ego and a market trying to find its footing. Priced at $82,699 with a market capitalization of $1.65 trillion, bitcoin floated within a 24-hour trading band of $81,953 to $84,367. Its daily volume printed a notable $53.64 billion—ample

BTC-1.92%

Coinpedia·26m ago

Monad (MON) To Bounce Further? Key Potential Bullish Pattern Formation Suggest So!

_Key Takeaways_

_Monad (MON) has dropped nearly 41% over the past two months but is showing early signs of stabilization._

_Price action s

MON-9.34%

CoinsProbe·27m ago

Sky (SKY) To Rise Further? This Emerging Bullish Pattern Formation Suggests So!

_Key Takeaways_

_SKY is forming a rounding bottom pattern on the daily chart_

_Price has rebounded strongly from the $0.0419 demand

SKY-3.29%

CoinsProbe·32m ago

$30M SOL Vanishes as Step Finance Confirms Wallet Hack

_Step Finance confirms a wallet hack after $30M SOL was unstaked and transferred, raising security concerns across Solana DeFi ecosystem._

Step Finance confirmed a security hack after unauthorized activity impacted several treasury and fee wallets. As a result, significant SOL outflows were

SOL-5.44%

LiveBTCNews·43m ago

Hong Kong Regulators to Submit Draft Crypto Framework Bill in 2026

Hong Kong’s regulatory arc for digital assets is moving from consultation to drafting, with officials outlining a concrete timetable for 2026. In remarks prepared for the Legislative Council’s Finance Committee, Secretary for Financial

CryptoBreaking·43m ago

South Korea Enters the World’s Top 10 Stock Markets

The South Korea stock market has reached a historic milestone by overtaking Germany to become the world’s tenth largest equity market. This achievement reflects more than a numerical shift within global stock markets. It highlights South Korea’s growing dominance in technology, innovation, and

Coinfomania·50m ago

SHIB Dev Drops Surprising Analogy as Shiba Inu Community Awaits Fresh Update - U.Today

Kaal Dhairya, a Shiba Inu developer, likens visionaries to artists, emphasizing rejection faced by creators. He defends Shytoshi Kusama amid criticism, recalling past support during SHIB's rise. He asserts the community's resilience and anticipates critical developments on an important upcoming Sunday.

SHIB-6.75%

UToday·1h ago

U.S. Treasury Sanctions UK Crypto Exchanges for Iran Sanctions Evasion

The U.S. Treasury sanctioned UK crypto exchanges Zedcex and Zedxion for aiding Iran in evading sanctions, marking the first direct action against such platforms. The sanctions highlight the importance of compliance in the crypto industry amid evolving financial technologies.

TheNewsCrypto·1h ago

Visa, Mastercard Doubt Stablecoins for Daily Payments

Visa says stablecoins lack product market fit in developed markets where fast bank payments already meet consumer needs.

Mastercard supports stablecoins as a currency on its rails, partnering widely while rejecting disruption of existing networks.

Despite on chain growth and SoFi

CryptoFrontNews·1h ago

Visa Stablecoin Expands Across Multiple Blockchains in 2026

Visa has established a global stablecoin settlement system across multiple blockchains, processing over $3.5 billion annually. Utilizing a multi-chain strategy, it leverages Ethereum for security while employing Solana, Stellar, and Avalanche for efficiency, signaling a significant shift in traditional finance towards blockchain integration.

Coinfomania·1h ago

Bitcoin Quantum Risk Remains Distant, Says Raoul Pal

Raoul Pal argues that fears of quantum computing threatening Bitcoin are overstated, as any significant attack would lead to price crashes, making theft unprofitable. He emphasizes that Bitcoin can adapt with future upgrades, ensuring long-term security while current threats remain distant.

BTC-1.92%

Coinfomania·1h ago

$1.82 billion USD withdrawn from Bitcoin and Ether ETFs as precious metals surge

In the past five trading sessions, investors withdrew approximately $1.82 billion from Bitcoin and Ether spot ETFs in the U.S. due to deteriorating market sentiment. Bitcoin dropped 6.55% while Ether fell 8.99%, despite a brief prior increase driven by speculation around a U.S. bill.

BTC-1.92%

TapChiBitcoin·1h ago

Load More

Hot Topics

MoreCrypto Calendar

MoreTokens Unlock

Berachain BERA will unlock 63,750,000 BERA tokens on February 6th, constituting approximately 59.03% of the currently circulating supply.

2026-02-05

Tokens Unlock

Wormhole will unlock 1,280,000,000 W tokens on April 3rd, constituting approximately 28.39% of the currently circulating supply.

2026-04-02

Tokens Unlock

Pyth Network will unlock 2,130,000,000 PYTH tokens on May 19th, constituting approximately 36.96% of the currently circulating supply.

2026-05-18

Tokens Unlock

Pump.fun will unlock 82,500,000,000 PUMP tokens on July 12th, constituting approximately 23.31% of the currently circulating supply.

2026-07-11

Tokens Unlock

Succinct will unlock 208,330,000 PROVE tokens on August 5th, constituting approximately 104.17% of the currently circulating supply.

2026-08-04