2025 年 OSMO 價格展望:全面剖析 Osmosis Protocol 原生代幣的成長驅動因素與市場前景

引言:OSMO 的市場定位與投資價值

Osmosis(OSMO)自 2021 年以 Cosmos SDK 打造,成為先進的自動化做市商(AMM)協議,並持續於產業取得突破。至 2025 年,OSMO 市值達 102,544,982.72 美元,流通量約 745,239,700 枚,最新報價 0.1376 美元。業界普遍認定 OSMO 為「Cosmos 生態 AMM 的關鍵力量」,在去中心化金融(DeFi)與跨鏈流動性領域扮演不可替代角色。

本文將針對 OSMO 從歷史走勢、市場供需、生態成長以及宏觀經濟多面向,系統化剖析其 2025 至 2030 年價格表現。將分別提供投資人專業預測與策略參考。

一、OSMO 歷史價格回顧與現行市場動態

OSMO 歷史價格演變

- 2022 年:曾於 3 月 4 日創下歷史新高 11.25 美元。

- 2024 年:市場大幅修正,價格顯著走低。

- 2025 年:價格從高點下跌至現今低位 0.134708 美元。

OSMO 當前市場狀況

OSMO 現價 0.1376 美元,過去 24 小時跌幅 1.36%。一週累計跌 15.53%,近一個月跌 17.56%,年度跌幅高達 76.71%。市值 102,544,982.72 美元,於加密市場排第 436 位。現價與歷史高點相比,已下跌 98.78%,顯示長期弱勢。24 小時成交量 26,856.29 美元,市場活躍度屬中等。情緒持續低迷,價格接近歷史低點。

瀏覽 OSMO 即時市場價格

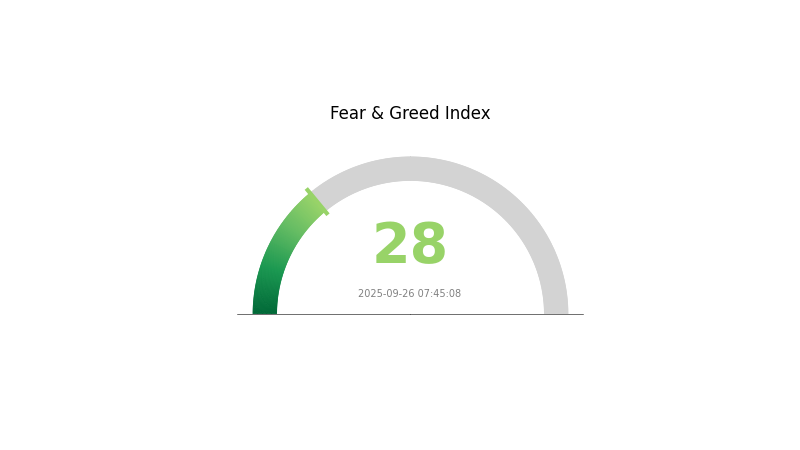

OSMO 市場情緒指標

2025 年 9 月 26 日,恐懼與貪婪指數為 28,屬「恐懼」狀態

立即查詢 恐懼與貪婪指數

目前 OSMO 市場信心處於「恐懼」區間。恐懼與貪婪指數顯示投資人多以觀望、謹慎為主。雖然有逆勢布局的機會,投資人仍應詳加研究,並審慎評估個人風險屬性。建議分散配置,並制定長期策略,以因應加密市場高波動特性。

OSMO 持幣分布現況

OSMO 地址分布展現分散持幣結構,有助於判斷網路去中心化程度及市場型態。

數據顯示「大戶」集中持有狀況並不顯著,分布趨於平均,有助於維持生態穩健及去中心化屬性。

分散持幣結構有助於降低因大額轉帳導致的價格波動及操控風險,也突顯 OSMO 社群活躍與生態韌性。這樣的格局契合去中心化原則,為 OSMO 建立公平且可持續發展的網路基石。

查詢最新持幣分布 OSMO 持幣分布

| Top | Address | Holding Qty | Holding (%) |

|---|

二、影響 OSMO 未來價格的核心因素

供給機制分析

- 歷史演化:過往供給調整引發激烈價格波動,2024 年跌幅尤其顯著。

- 近期影響:供給結構持續帶來價格壓力。

機構及巨鯨動向

- 機構持倉:目前 OSMO 獲得機構關注度明顯低於主流加密資產,相關數據有限。

宏觀經濟環境

- 地緣政治:國際緊張局勢及其市場層面影響,可能持續主導 OSMO 價格波動。

技術創新與生態擴展

-

生態應用:Osmosis 生態成長、去中心化應用(DApp)開發,將驅動未來價值提升。

-

市場競爭:Layer-2 及跨鏈協議的競爭項目不斷浮現,可能影響 OSMO 市場地位與價格走勢。

三、OSMO 2025-2030 年價格展望

2025 年預測區間

- 保守:0.1325 - 0.1366 美元

- 中性:0.1366 - 0.14 美元

- 樂觀:0.14 - 0.14889 美元(需市場情緒向好)

2027-2028 年展望

- 市場階段:有望迎來新一輪成長期

- 價格區間預測:

- 2027 年:0.09673 - 0.21936 美元

- 2028 年:0.11959 - 0.23917 美元

- 關鍵動能:Osmosis 協議滲透率提升及 DeFi 市場擴容

2029-2030 年長線預期

- 基本情境:0.21761 - 0.25025 美元(市場溫和成長假設)

- 樂觀情境:0.28289 - 0.35785 美元(假設 DeFi 強力成長)

- 極端利好:超過 0.35785 美元

- 預估 2030 年 12 月 31 日最高價:0.35785 美元

| 年份 | 預估最高價 | 預估平均價 | 預估最低價 | 漲跌幅 |

|---|---|---|---|---|

| 2025 | 0.14889 | 0.1366 | 0.1325 | 0 |

| 2026 | 0.2027 | 0.14275 | 0.07994 | 3 |

| 2027 | 0.21936 | 0.17272 | 0.09673 | 25 |

| 2028 | 0.23917 | 0.19604 | 0.11959 | 42 |

| 2029 | 0.28289 | 0.21761 | 0.1458 | 58 |

| 2030 | 0.35785 | 0.25025 | 0.14264 | 81 |

四、OSMO 投資策略與風險管理

OSMO 投資方法論

(1) 長期持有策略

- 適合族群:長期主義及 DeFi 用戶

- 操作建議:

- 分批買入 OSMO

- 參與 Osmosis 治理

- 建議將資產存放在安全的非託管錢包中

(2) 主動操作策略

- 技術分析工具:

- 均線(MA):辨識趨勢變化

- 相對強弱指數(RSI):判讀超買/超賣區間

- 波段操作要點:

- 持續關注 Cosmos 生態的最新動態

- 留意 OSMO 流動性與成交結構

OSMO 風險管理框架

(1) 資產比例建議

- 穩健型:1-3%

- 激進型:5-10%

- 專業型:10-15%

(2) 對沖與分散方案

- 多元配置:投資 Cosmos 生態中的多種代幣

- 停損機制:設置合理停損線

(3) 安全儲存方案

- 推薦使用 Gate Web3 熱錢包(Hot Wallet) 錢包

- 冷錢包(Cold Wallet):長期存放建議使用硬體錢包

- 安全提醒:啟用雙重驗證並妥善備份私鑰

五、OSMO 潛在風險與挑戰

市場風險

- 高度波動:加密市場劇烈波動為常態

- 流動性風險:極端市況下可能出現流動性問題

- 競爭壓力:Cosmos 生態新 AMM 項目持續湧現

合規風險

- 監管尚未明朗:DeFi 法規變動速度快,未來存不確定性

- 跨境合規挑戰:多地司法規範挑戰多元且複雜

- 稅務相關議題:DeFi 相關稅收認定仍不明確

技術風險

- 智能合約漏洞:協議程式存在潛在風險

- 網路擁塞:高負載容易造成可擴展性瓶頸

- 鏈間互動可能產生安全疑慮

六、結論與投資行動建議

OSMO 投資價值評斷

OSMO 在 Cosmos 生態具備長線成長潛力,惟短期波動性與合規不確定性不可輕忽。

投資建議

✅ 新手:建議小額嘗試,優先認識 Osmosis 生態運作

✅ 有經驗者:整合長期持有與主動布局,維持資產平衡

✅ 機構投資人:建議拓展策略合作並參與社群治理

參與 OSMO 交易方式

- 現貨交易:可於主流平台(如 Gate.com)交易

- DeFi 參與:於 Osmosis DEX 注入流動性

- 質押挖礦:加入網路安全建設並獲取生態獎勵

加密貨幣投資風險極高,本文僅供參考,不構成投資建議。投資人應根據自身風險承受力審慎決策,並優先洽詢專業理財顧問。請勿投入超過自身可承受範圍的資金。

常見問題

Osmosis 目前適合作為買入標的嗎?

根據近期行情,目前不建議立即進場。近一個月波動劇烈,上漲交易日僅約占一半。

OSMO 最新市價是多少?

截至 2025 年 9 月 26 日,OSMO 市價為 0.1666 美元,24 小時成交量 37,710 美元,跌幅為 6.49%。

Mog Coin 2040 年價格預期為何?

預計 Mog Coin 至 2040 年有機會達到 0.000001944 美元,但長期預測變數大,僅供參考。

2025 年主流加密貨幣預估最高價為多少?

比特幣(BTC)2025 年預估可突破 100,000 美元;以太幣(ETH)預計可達 5,000 美元,僅供參考,實際以市場狀況為準。

2025 年 OSMO 價格預測:深入剖析 Osmosis Network 原生代幣的成長潛力與市場發展趨勢

Osmosis(OSMO)值得投資嗎?:深入探討此 DeFi 協議代幣的潛力與風險

2025年 OSMO 價格展望:Cosmos 生態系統代幣有機會再創新高嗎?

2025年OSMO價格展望:Osmosis年底有機會突破5美元嗎?

Avalanche (AVAX) 2025年價格分析與市場趨勢

SEI權益質押分析:60-70%供應被鎖定及其價格影響

這是一款方便用於 Web3 環境下管理加密貨幣的錢包

GIGGLE加密貨幣如何利用數百萬活躍的Twitter粉絲與持續成長的DApp生態系,提升社群參與度?